Individual Health Insurance Membership Continues to Grow

September 14, 2021

While the individual market has faced challenges over the past year amidst implications from the pandemic, overall, the segment continues to see enrollment growth. According to financial statements filed by insurers and estimates by Mark Farrah Associates, enrollment in individual medical plans, both on and off the exchange, totaled approximately 15.9 million as of June 30, 2021. In addition, the Centers for Medicare & Medicaid Services (CMS) reported in the Health Insurance Exchanges 2021 Open Enrollment Report that approximately 12 million consumers enrolled in Marketplace plans following the 2021 open enrollment period (OEP). This includes more than 8.3 million enrolled in the 36 states using the HealthCare.gov platform and 3.8 million enrolled in State-Based Marketplaces. Open enrollment for 2021 coverage starts on Nov. 1st and runs through Dec. 15th, although some states, including New York, New Jersey, California and Washington D.C. have extended their open enrollment periods. In this brief, Mark Farrah Associates (MFA) provides insights into individual health insurance enrollment trends and market developments with state-by-state membership comparisons.

Leading Competitor Exchange Participation

In June 2021, health insurers reported total individual, non-group coverage for over 15.9 million people, based on statutory financial statements filed with state regulators and the NAIC (National Association of Insurance Commissioners) and the CA DMHC (California Department of Managed Health Care). This represents a 4.9% increase from the 15.2 million members in June 2020. Leading insurers for this segment include Centene, Guidewell Mutual, Kaiser and Anthem, Inc. Anthem and Kaiser experienced marginal membership gains of 1.1% and .9%, respectively, while Centene and Guidewell saw year-over-year enrollment declines in their individual business. Centene leads the nation with approximately 2.2 million Individual enrollees, however the company experienced an 8% year-over-year decrease in membership.

| Individual Segment - Members | |||

| Company | 2Q20 | 4Q20 | 2Q21 |

| Centene | 2,343,042 | 2,248,426 | 2,155,792 |

| Guidewell Mutual (Florida BCBS) | 1,269,954 | 1,173,709 | 1,267,180 |

| Kaiser | 1,138,215 | 1,083,121 | 1,148,145 |

| Anthem | 1,069,332 | 1,011,278 | 1,080,615 |

Source: Health Coverage Portal™, Mark Farrah Associates, presenting data from NAIC, CA DMHC and CMS

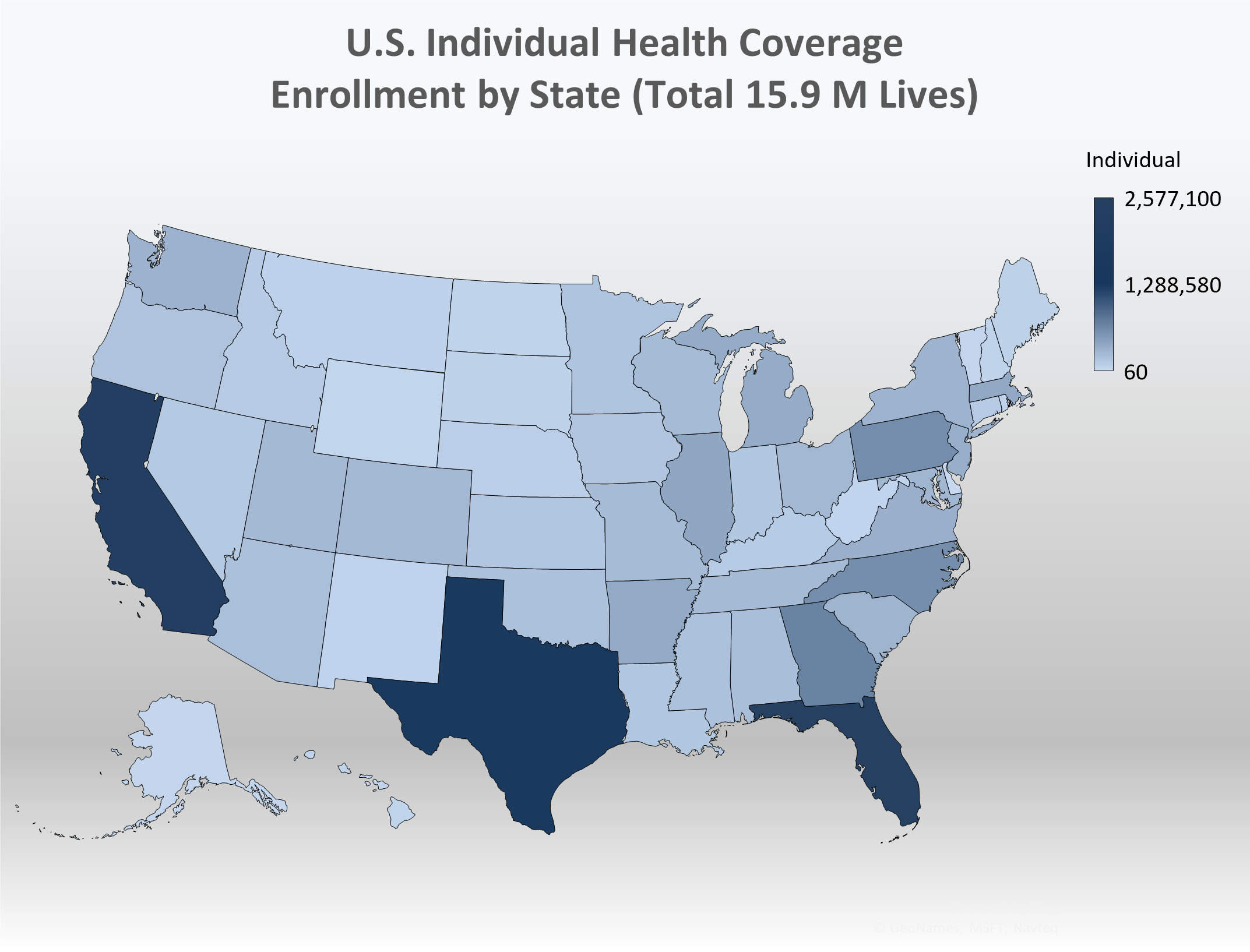

U.S. Individual Health Coverage

As indicated in the heat map below, Florida, California, and Texas had the highest number of enrollees, with Florida covering nearly 2.6 million members as of 2Q21. It is important to note that Mark Farrah Associates (MFA) applied enrollment figures for select carriers not required to report health enrollment on a quarterly basis and made other adjustments based on market analysis. Furthermore, individual enrollment includes short term plan enrollees and may include Medicaid programs, such as CHIP, as some states include subsidized lines in the individual segment. These factors may have resulted in moderate understatement or overstatement of enrollment.

Source: Health Coverage Portal™, Mark Farrah Associates, presenting data from NAIC, CA DMHC and CMS

The table below presents state-by-state breakdowns of the total individual market, separating on and off-exchange membership. For this assessment, MFA applied the assumption that the difference between total individual enrollment reported by carriers and on-exchange, Marketplace enrollment reported in CMS’s Open Enrollment Period (OEP) public use files is a reasonable representation of off-exchange membership. This analysis did not include state-by-state research to provide local market insights about exchange positioning nor did the analysts investigate off-exchange plan options. Nonetheless, the state breakdowns provide a framework for understanding greater market opportunity. These figures indicate 75% of individual medical members were enrolled through Marketplace plans and 25% were enrolled in off-exchange plans.

|

State |

June 2021 Total Individual Enrolled |

2021 On-Exchange Enrolled |

Estimated Off-Exchange Enrolled |

|

AK |

18,762 |

18,184 |

578 |

|

AL |

210,315 |

169,119 |

41,196 |

|

AR |

372,831 |

66,094 |

306,737 |

|

AZ |

200,957 |

154,504 |

46,453 |

|

CA |

2,306,168 | 1,625,546 | 680,622 |

|

CO |

255,946 |

179,607 |

76,339 |

|

CT |

113,436 |

104,946 |

8,490 |

|

DC |

38,631 |

16,947 |

21,684 |

|

DE |

60 |

25,320 |

-25,260 |

|

FL |

2,577,100 |

2,120,350 |

456,750 |

|

GA |

680,455 |

517,113 |

163,342 |

|

HI |

38,548 |

22,903 |

15,645 |

|

IA |

153,106 |

59,228 |

93,878 |

|

ID |

103,584 |

68,832 |

34,752 |

|

IL |

396,746 |

291,215 |

105,531 |

|

IN |

142,931 |

136,593 |

6,338 |

|

KS |

149,030 |

88,627 |

60,403 |

|

KY |

110,885 |

77,821 |

33,064 |

|

LA |

140,984 |

83,159 |

57,825 |

|

MA |

375,869 |

294,097 |

81,772 |

|

MD |

277,103 |

166,038 |

111,065 |

|

ME |

63,187 |

59,738 |

3,449 |

|

MI |

354,167 |

267,070 |

87,097 |

|

MN |

166,042 |

112,804 |

53,238 |

|

MO |

231,376 |

215,311 |

16,065 |

|

MS |

184,153 |

110,966 |

73,187 |

|

MT |

52,329 |

44,711 |

7,618 |

|

NC |

596,207 |

535,803 |

60,404 |

|

ND |

44,604 |

22,709 |

21,895 |

|

NE |

86,810 |

88,688 |

-1,878 |

|

NH |

46,431 |

46,670 |

-239 |

|

NJ |

332,802 |

269,560 |

63,242 |

|

NM |

43,620 |

42,984 |

636 |

|

NV |

126,160 |

81,903 |

44,257 |

|

NY |

295,025 |

215,889 |

79,136 |

|

OH |

256,005 |

201,069 |

54,936 |

|

OK |

185,165 |

171,551 |

13,614 |

|

OR |

168,480 |

141,089 |

27,391 |

|

PA |

599,861 |

337,722 |

262,139 |

|

RI |

42,781 |

31,174 |

11,607 |

|

SC |

290,424 |

230,050 |

60,374 |

|

SD |

54,063 |

31,375 |

22,688 |

|

TN |

237,437 |

212,052 |

25,385 |

|

TX |

1,583,267 |

1,291,972 |

291,295 |

|

UT |

251,852 |

207,911 |

43,941 |

|

VA |

330,299 |

261,943 |

68,356 |

|

VT |

29,295 |

24,866 |

4,429 |

|

WA |

306,684 |

222,731 |

83,953 |

|

WI |

230,937 |

191,702 |

39,235 |

|

WV |

33,610 |

19,381 |

14,229 |

| WY | 29,513 | 26,728 | 2,785 |

|

Total |

15,916,033 |

12,004,365 |

3,911,668 |

Source: Health Coverage Portal™, Mark Farrah Associates, presenting data from NAIC, CA DMHC and CMS

Individual Market Financial Performance

As we reported on August 31, 2021 in our strategy brief titled “An Analysis of Profitability for the Individual and Small Group Health Insurance Markets in 2020 ”, profitability for health insurance companies reached its low point in 2015 with a nearly $6 billion underwriting loss. Since then, through years of premium increases which outpaced growth in medical spending, companies have now posted four consecutive years of underwriting gains for the individual segment totaling over $22 billion. For 2Q20 and 2Q21, plans in the individual segment reported a 1.6% increase overall in premiums per member per month (PMPM), from $36.3 billion to $38.5 billion in premiums earned.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health PLUS, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.