Year-Over-Year Health Insurance Enrollment Trends by Segment

April 28, 2022

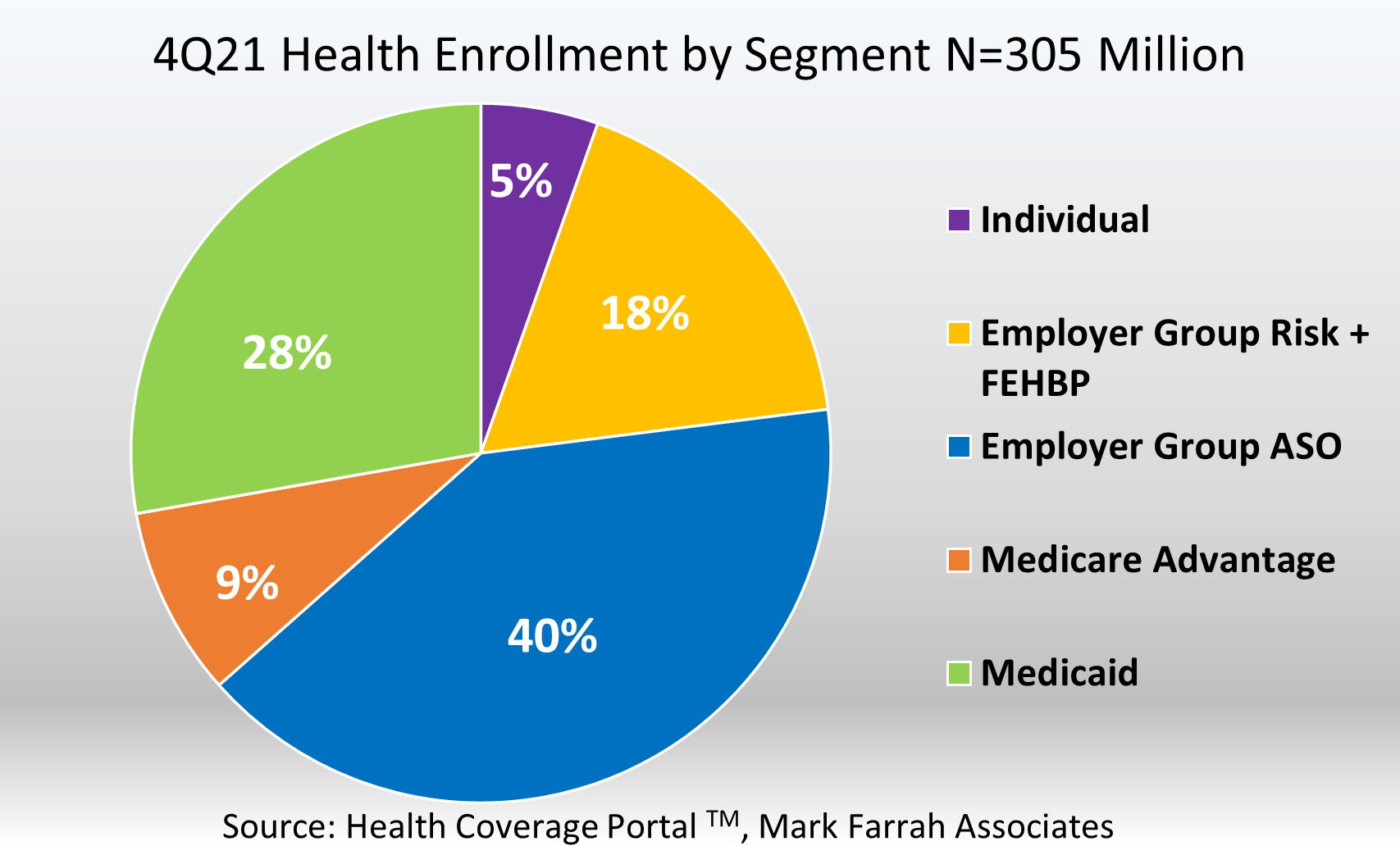

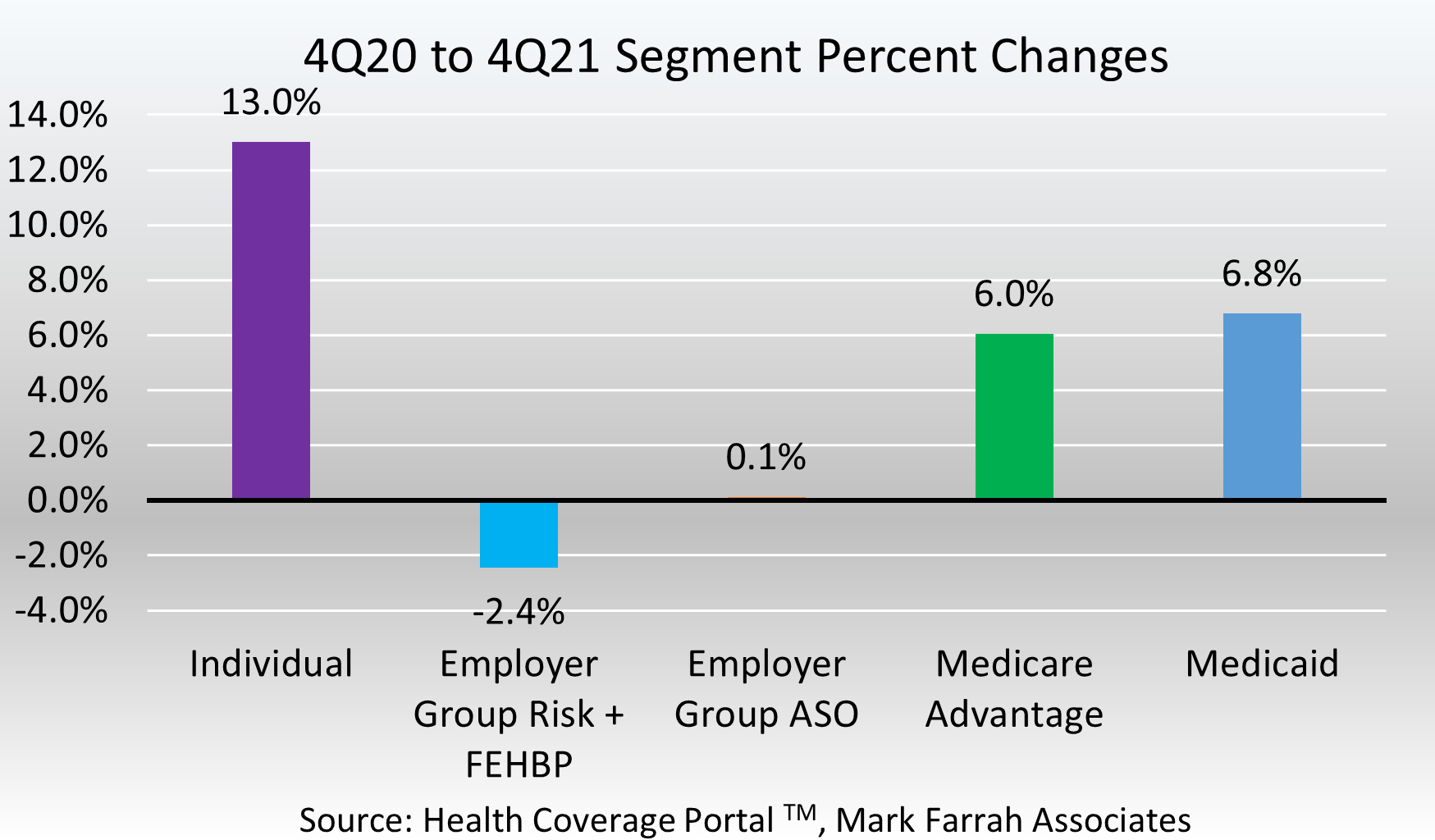

Based on data filed in statutory financial reports from the NAIC (National Association of Insurance Commissioners), the CA DMHC (California Department of Managed Health Care), CMS (Centers for Medicare and Medicaid Services) and various state agencies, approximately 305 million people received medical coverage from U.S. health insurers as of December 31, 2021. This number is up from 297.5 million, or approximately 7.6 million additional members, from a year ago. Between 4Q20 and 4Q21, membership growth was significant in Medicare Advantage as this segment gained approximately 1.5 million more members. In addition, the individual health insurance market and Managed Medicaid also experienced marked membership increases. The Employer-group ASO (administrative services only for self-funded plans) and Employer-group risk segments provide the largest sources of coverage in the industry, however, these segments combined continued to demonstrate year-over-year declines in enrollment. In this brief, Mark Farrah Associates (MFA) assesses the latest year-over-year enrollment trends, comparing fourth quarter 2020 with fourth quarter 2021 segment membership.

- The Individual segment experienced a substantial enrollment increase between December 31, 2020, and December 31, 2021. Total year-over-year membership for this segment grew 13% from 14.6 million enrollees to over 16.5 million. This is an increase of 1.9 million members. This increase is most likely caused by an influx of members who lost employer sponsored health coverage due to the economic downturn caused by COVID-19, as well as the extended Open Enrollment Period.

- Approximately 84.7 million beneficiaries received healthcare through Managed Care Organizations (MCOs) and Fee-for-Service type Medicaid programs as of December 31, 2021. This is a 6.8% increase from December 2020, based on membership filed in statutory financial reports from the NAIC and the CA DMHC, as well as state reported Medicaid and CMS reported Medicaid enrollment reports. Note: a portion of CHIP (Children’s Health Insurance Program) enrollment is reported in the Individual segment within statutory reporting.

- Enrollment in Medicare Advantage (MA) continues to grow at a steady rate as more and more American seniors are entering retirement. However, only 42% of the nearly 63.7 million people eligible for Medicare are enrolled in a MA plan, providing ample opportunity for health insurers with Managed Medicare business. Fourth quarter 2021 Medicare Advantage membership stood at approximately 26.8 million; a year-over-year increase of 1.5 million members, representing 6% growth, from December 31, 2020.

- Employer-groups continue to be the leading source of health coverage in the U.S, however, year-end figures indicated Employer-group risk membership, including Federal Employees Health Benefit Plans (FEHBP) members, experienced another decrease between 4Q20 and 4Q21. Membership for the Employer-group risk segment was 53.6 million as of December 31, 2021; a -2.4% year-over-year decline.

- Employer-group, self-funded contracts continue to remain popular amongst employers as they can be more cost effective than risk-based plans. Self-funding is specifically common among larger companies as they can disperse the risk of exorbitant claims over many workers and their dependents. According to MFA’s recent estimates, Employer-group ASO (administrative services only for self-funded business) membership was approximately 123.5 million. This was an increase of only 137,000 members from December of 2020. Membership for this segment encompassed 40.5% of total health enrollment for 4Q21, as self-funded ASO plans continue to be a viable option for businesses.

About the Data

The data used in this analysis brief was obtained from Mark Farrah Associates' Health Coverage Portal™ database. It is important to note that MFA estimated fourth quarter 2021 enrollment for a small number of health plans that are required to report quarterly enrollment but hadn’t yet filed. Employer group ASO figures may be estimated by Mark Farrah Associates using credible company and industry resources. Individual, Non-group membership reported by some carriers may include CHIP (Children’s Health Insurance Program). These adjustments may have resulted in moderate understatement or overstatement of enrollment changes by segment. Findings reflect enrollment reported by carriers with business in the U.S. and U.S. territories. Data sources include NAIC (National Association of Insurance Commissioners), the CA DMHC (California Department of Managed Health Care), CMS (Centers for Medicare and Medicaid Services) and various state agencies.

Market analysts throughout the industry rely on enrollment data and segment performance metrics to gain better insights into health plan market share and competitive positioning. As always, MFA will continue to report on important plan performance and competitive shifts across all segments.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health PLUS, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.