Mid-Year Health Insurance Segment Enrollment Trends

September 26, 2022

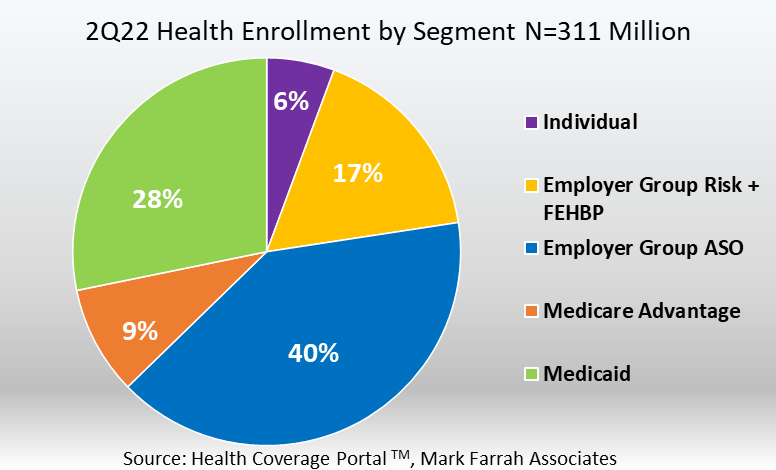

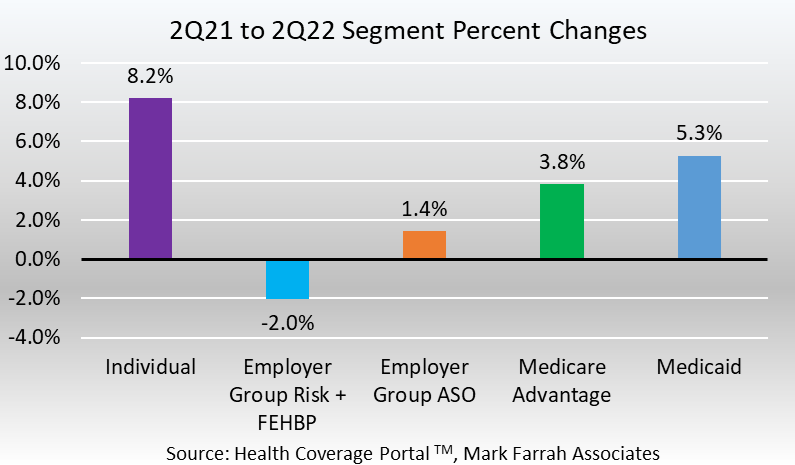

Based on data filed in statutory financial reports from the NAIC (National Association of Insurance Commissioners), the CA DMHC (California Department of Managed Health Care), CMS (Centers for Medicare and Medicaid Services) and various state agencies, over 311 million people received medical coverage from U.S. health insurers as of June 30, 2022. This number is up from 304 million, or approximately 7.4 million additional members, from a year ago. Between 2Q21 and 2Q22, membership growth was significant in the Individual, Employer Group ASO (administrative services only for self-funded plans), Medicare Advantage and Medicaid markets. However, the Employer Group Risk segment (including Federal Employees Health Plan members) experienced enrollment declines of approximately 1.08 million members. In this brief, Mark Farrah Associates (MFA) assesses the latest year-over-year enrollment trends, comparing second quarter 2021 with second quarter 2022 segment membership.

- The Individual segment experienced a notable enrollment increase between June 30, 2021, and June 30, 2022. Total year-over-year membership for this segment grew 8.2% from16.3 million enrollees to almost 17.6 million. This is an increase of 1.3 million members.

- Approximately 87.8 million beneficiaries received healthcare through Managed Care Organizations (MCOs) and Fee-for-Service type Medicaid programs as of June 30, 2022. This is a 5.3% increase from June 2021, or 4.4 million more members, based on membership filed in statutory financial reports from the NAIC and the CA DMHC, as well as state reported Medicaid and CMS reported Medicaid enrollment reports. Note: a portion of CHIP (Children’s Health Insurance Program) enrollment is reported in the Individual segment within statutory reporting. On July 15, 2022, Health and Human Services (HHS) renewed the determination that we are in a national COVID-19 public health emergency (PHE) through October 15, 2022. However, another 90-day extension is expected as providers still rely on the accompanying regulatory waivers and flexibilities. Until the PHE is lifted, Medicaid redeterminations continue to remain on hold and Medicaid enrollment will continue to increase.

- As more and more American seniors enter retirement, enrollment in Medicare Advantage (MA) continues to grow. However, only 44% of the nearly 65 million people eligible for Medicare are enrolled in a MA plan, providing ample opportunity for health insurers with Managed Medicare business. Second quarter 2022 MA membership stood at approximately 28.2 million, a year-over-year increase of 1.04 million members, representing 3.8% growth, from June 30, 2021. MA plans compete by offering new pricing and product options to beneficiaries during the Annual Election Period (AEP) which runs each year from October 15th through December 7th.

- Employer-groups continue to be the leading source of health coverage in the U.S, however, second quarter figures indicated Employer-group risk membership, including Federal Employees Health Benefit Plans (FEHBP) members, experienced another decrease between 2Q21 and 2Q22. Membership for the Employer-group risk segment was approximately 52.7 million as of June 30, 2022; a -2% year-over-year decline.

- According to MFA’s second quarter 2022 estimates, Employer-group ASO (administrative services only for self-funded business) membership was approximately 125 million. This was an increase of 1.7 million members, 1.4%, from June of 2021. Membership for this segment encompassed 40.1% of total health enrollment for 2Q22, as self-funded ASO plans continue to remain popular amongst employers, as they are generally perceived as more cost effective than risk-based plans.

Market analysts throughout the industry rely on enrollment data and segment performance metrics to gain better insights into health plan market share and competitive positioning. As always, MFA will continue to report on important plan performance and competitive shifts across all segments.

About the Data

The data used in this analysis brief was obtained from Mark Farrah Associates' Health Coverage Portal™ database. It is important to note that MFA estimated Second quarter 2022 enrollment for a small number of health plans that are required to report quarterly enrollment but hadn’t yet filed. Employer group ASO figures may be estimated by Mark Farrah Associates using credible company and industry resources. Individual, Non-group membership reported by some carriers may include CHIP (Children’s Health Insurance Program). These adjustments may have resulted in moderate understatement or overstatement of enrollment changes by segment. Findings reflect enrollment reported by carriers with business in the U.S. and U.S. territories. Data sources include NAIC (National Association of Insurance Commissioners), the CA DMHC (California Department of Managed Health Care), CMS (Centers for Medicare and Medicaid Services) and various state agencies.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health PLUS, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.