Medicare Supplement Enrollment Up Nearly 4% in 2018

May 20, 2019

The rapidly expanding U.S. senior population continues to present increasing opportunities for health insurers offering Medicare Supplement plans. Many leading managed care organizations, Blues plans, regional plans, and multiline carriers compete in the Medicare Supplement (also known as Med Supp or Medigap) arena. As of December 31, 2018, the Med Supp market experienced yet another year of membership growth. Based on performance data filed in annual financial statements from the NAIC (National Association of Insurance Commissioners), enrollment in Medicare Supplement plans was almost 13.6 million as of December 31, 2018, up 3.95% year-over-year.

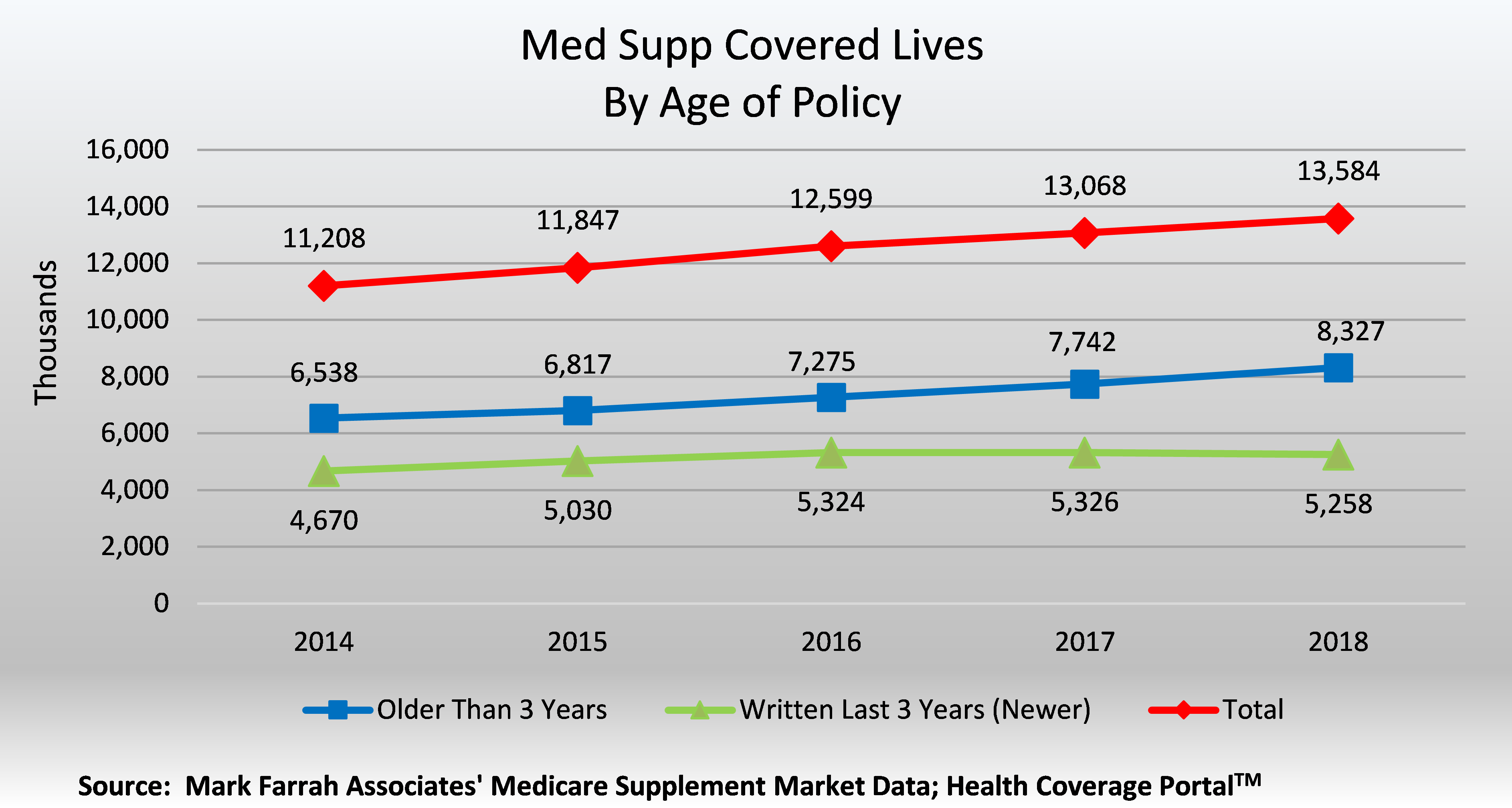

Mark Farrah Associates (MFA) identified 196 distinct carriers that filed annual data with the NAIC. Breakdowns of in-force policies show that carriers issued policies to almost 5.3 million new members written in the last three years. Carriers reported an aggregate of 8.3 million members covered by older policies that had been issued prior to the year 2016. This brief provides an overview of the Medicare Supplement market with insights about competitive positioning and standardized plan type preferences.

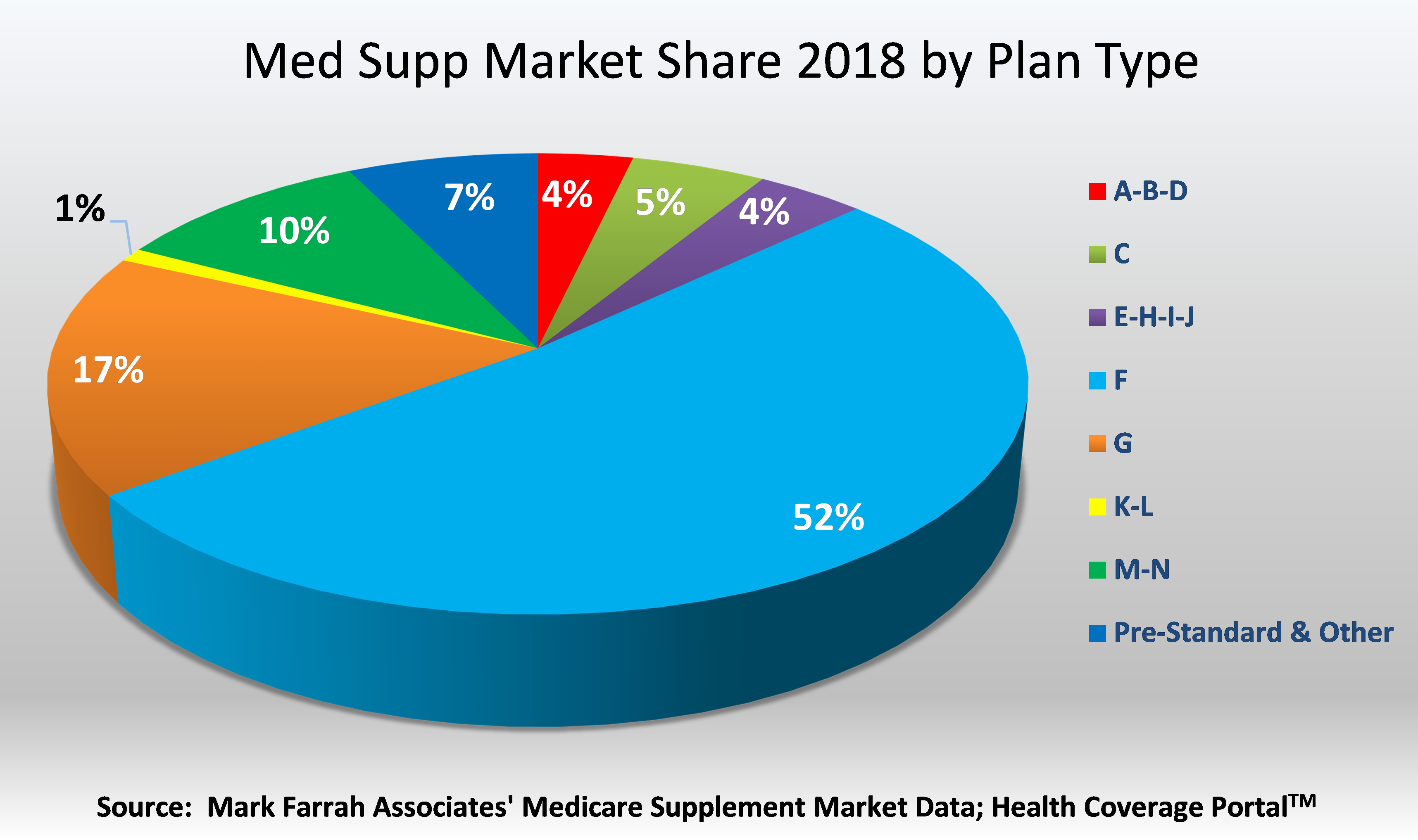

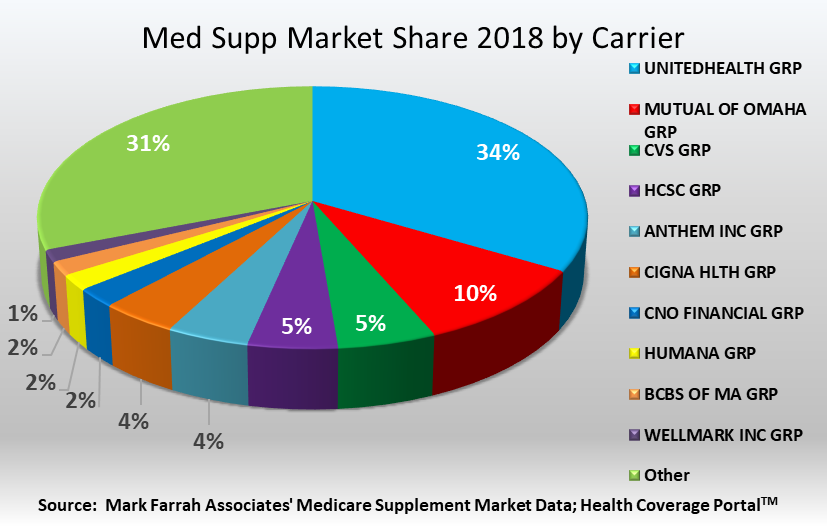

Medicare Supplement carriers added approximately 517,000 covered lives to their portfolios between December 31, 2017 and December 31, 2018. About 17% of this market growth is attributed to UnitedHealth’s membership increase. Among standardized plans A-N, Plan F covers the annual Medicare Part B deductible and offers the most comprehensive benefits. Per the graph below, Plan F enrolled almost 7.05 million Med Supp members and accounted for approximately 52% of the market. However, this number decreased by 15,000 year-over-year.

This decline in Plan F membership is largely due to a provision in the Medicare Access and CHIP Reauthorization Act of 2016 (MACRA). Beginning January 1, 2020, Plan F will no longer be an option for newly eligible Medicare enrollees, whereby supplemental plans covering the Part B deductible can no longer be purchased. Beneficiaries who continue to pay their existing Medicare Supplement Plan F premium will not lose that coverage. This policy change has begun the shift in growth from Plan F into Plans G and N which are widely seen as viable alternatives to Plan F. Both Plans G and N continued to experience year-over-year increases with Plan G notably enrolling 645,000 new members; a growth rate of 39%.

**Note plan type “P” for Pre-Standardized is used for policies issued prior to the enactment of the Omnibus Reconciliation Act (OBRA) of 1990, which standardized benefits for Medicare Supplement plan types. Plan type “O” or “Other” is used by carriers in a few states including Massachusetts, Minnesota, and Wisconsin that receive waivers to the standardized Medicare Supplement regulations.

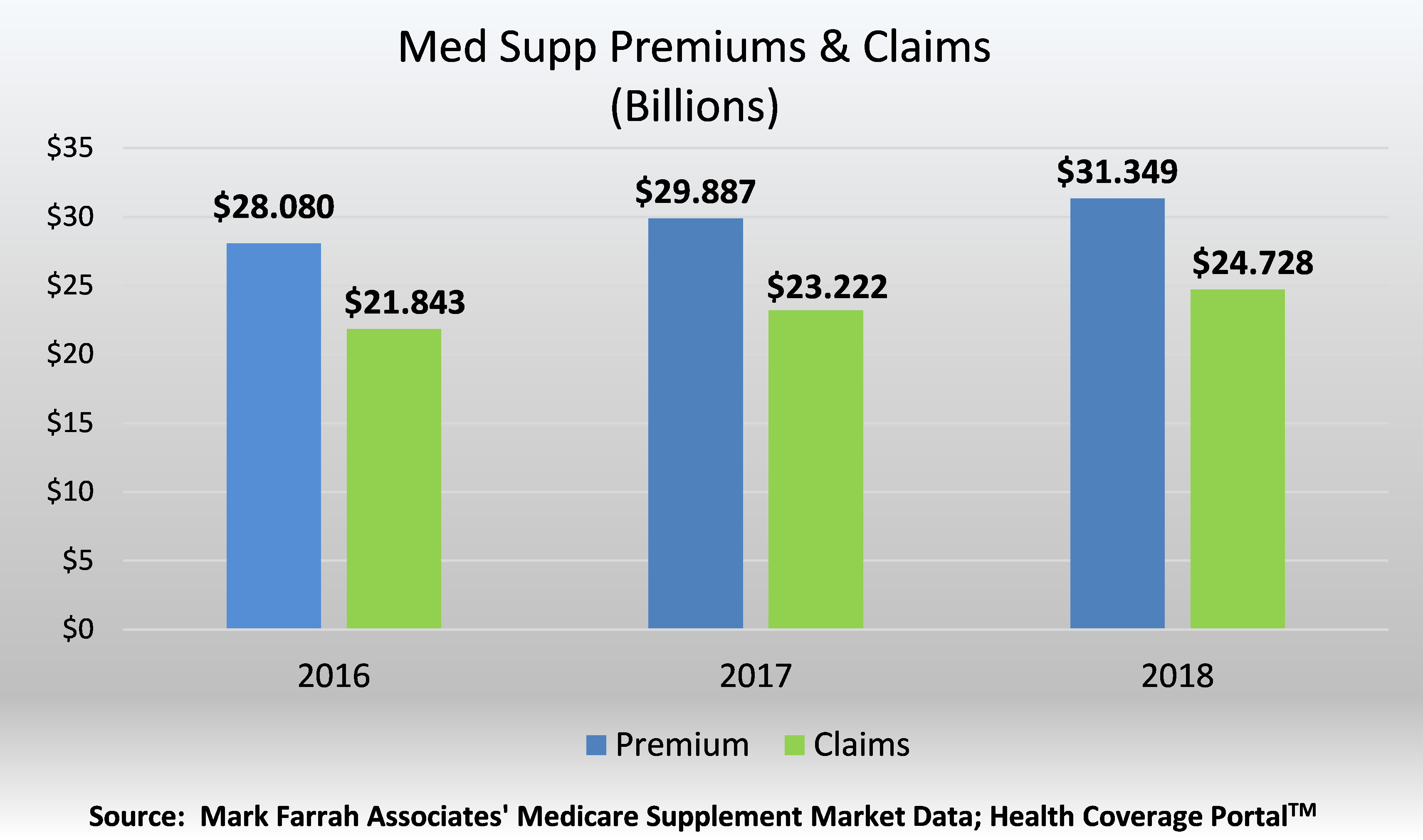

The Medicare Supplement market remains an attractive line of business for carriers. Med Supp plans collectively earned approximately $31.3 billion in premiums and incurred $24.7 billion in claims during 2018, up from 2017. The aggregate loss ratio (incurred claims as a percent of earned premiums) was 78.9% in 2018, an increase from 77.7% in 2017.

The top 10 companies command almost 69% of the Med Supp market with approximately 9.4 million members. UnitedHealth, with its longstanding contract with AARP, continues to hold 34% of the market with more than 4.5 million members. Mutual of Omaha ranked second with 10% market share and approximately 1.4 million members as of December 31, 2018. CVS, formerly Aetna, supplanted Health Care Service Corporation (HCSC) as the third largest plan in 2018, with 702,000 enrolled. Anthem remains in the fifth ranking position for market share with over 590,000 members and Cigna experienced strong growth, increasing its membership by 129,000 members, with over 560,000 enrolled.

With over 65 million Medicare beneficiaries residing in the U.S., Medicare Supplement policies continue to be a viable option for seniors, as these plans can help pay some of the medical costs not covered by Original Medicare. Therefore, insurers continue to diversify their senior market portfolios to leverage opportunities across all product lines and expand product options in order to keep up with industry trends. Mark Farrah Associates will continue to monitor enrollment and plan performance in this competitive segment.

About Med Supp Market Data

Med Supp Market Data, a subscription option through Mark Farrah Associates’ Health Coverage Portal™, presents the latest market share and financial performance data for Medicare Supplement plans. The product includes state-by-state membership, premiums, claims and loss ratios for plans nationwide. Online tables also include claims contacts as reported in the financial statements as filed with the National Association of Insurance Commissioners (NAIC). California managed care plans do not file financial statements with the NAIC and are not included in this analysis. For more information about Med Supp Market Data, please visit our website or call 724.338.4100.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section at the bottom of this page.