Medicare Market Insights and Plan Competition for 2019

October 15, 2018

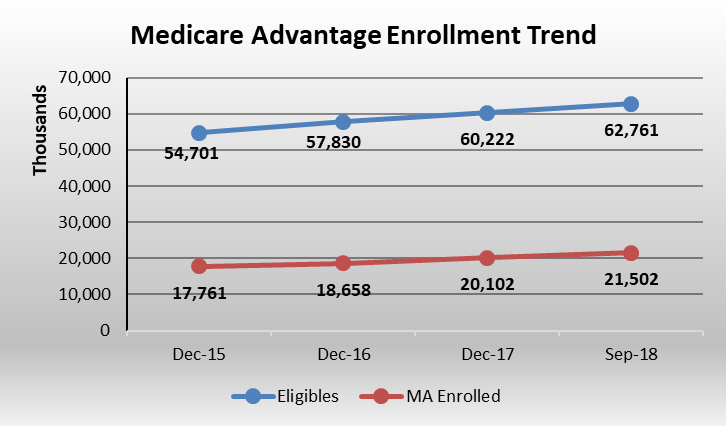

Medicare Advantage (MA) plans have been eagerly preparing their Medicare products in anticipation of the 2019 Annual Election Period (AEP) which is now upon us. The 2019 Medicare Advantage market is comprised of national health plans, Blue Cross Blue Shield organizations, prominent regional health plans and specialized Medicare companies. MA plans currently provide medical coverage for over 21.5 million beneficiaries. In the last three years, these plans have collectively increased enrollment by approximately 3.7 million members and currently cover over 34% of the nearly 63 million people eligible for Medicare benefits.

As Medicare companies finalize sales and marketing strategies, they analyze data from Medicare Plan Finder (MPF), an online tool that makes it easy for seniors to review options and shop for new Medicare plans. Medicare Benefits Analyzer™ , a Mark Farrah Associates’ database, helps simplify the analysis of the Medicare Plan Finder data for companies competing in this segment. This brief presents a snapshot of the 2019 Medicare Advantage market with insights from the Centers for Medicare and Medicaid Services (CMS) Medicare Landscape reports and discusses the plans that will be vying for business during the AEP.

Source: Mark Farrah Associates' Medicare Business Online TM presenting data from CMS monthly enrollment reports.

The Competitive Medicare Landscape

MA plans, along with stand-alone PDPs (prescription drug plans), are immersed in competitive assessments as beneficiaries begin to choose plans during this Annual Election Period, which runs between October 15th and December 7th . Based on an aggregate analysis of CMS Landscape reports, a total of 3,810 distinct Medicare Advantage (MA) plan offerings are in the market lineup for the onset of the 2019 AEP. This includes MA plans, Medicare Advantage with prescription drug plans (MAPDs), Medicare/Medicaid plans (MMPs), and Special Needs Plans (SNPs). During the AEP, Medicare beneficiaries can choose to change MA plans or switch from Original Medicare to MA, and plan benefits will become effective on January 1, 2019.

MFA’s analysis of CMS landscape data found a total of 3,077 MA plans being offered for 2019, including MMPs, up from 2,619 in 2018. In addition, a total of 733 Special Needs Plans (SNPs) are available in 2019, up from 640 in 2018. Health Maintenance Organizations (HMOs) represent 68% of all MA plan types with over 2,600 offerings for the coming year. Stand-alone PDPs nationwide increased for 2019 with 910 plan offerings, as compared to 795 plans in 2018.

According to the CMS press release, Medicare Advantage premiums continue to decline while plan choices and benefits increase in 2019 ; Medicare Advantage average monthly premiums will decrease 6% from 2018, falling to $28. Enrollment is projected to experience 11.5% growth over 2018. In addition, over 91% of people with Medicare will have access to 10 or more Medicare Advantage plans, which is up from 86% for 2018.

|

Year |

Cost |

Local HMO |

Local PPO |

MMP |

MSA |

PFFS |

Regional PPO |

Total |

| 2018 |

84 |

1,739 |

636 |

54 |

3 |

54 |

49 |

2,619 |

| 2019 |

68 |

1,946 |

905 |

50 |

6 |

52 |

50 |

3,077 |

| Year | Local HMO | Local PPO | Regional PPO | Total |

| 2018 |

574 |

53 | 13 | 640 |

| 2019 | 659 | 61 | 13 | 733 |

| Year | PDP |

| 2018 | 795 |

| 2019 | 910 |

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare Plan Finder and Landscape Source Files; excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

| Count | Percent | |

| Total Number of Plans | 3,077 | 100% |

| Plans without Part D | 307 | 10% |

| Plans with Part D | 2,770 | 90% |

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare Plan Finder and Landscape Source Files; excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

A total of 2,770, or 90% of MA plans, include Part D benefits, and total monthly premiums range from $0 to $313. Forty-five percent of 2019 MA plans (excluding SNPs), are available at the $0 plan premium level. Per the breakdown in the table below, 27% of all plans will be charging monthly premiums ranging from $2 to $50 while 17% of plan premiums are in the $51 to $100 range. Only 2% or 61 plans are charging monthly premiums greater than $200. These benefits-rich plans typically have low copays and as a result estimated out-of-pocket expenses are often minimal.

| Count | Percent | |

| Total Number of Plans | 3,077 | 100% |

| $0 Premium | 1,377 | 45% |

| $2 - $50 Premium | 819 | 27% |

| $51 - $100 Premium | 514 | 17% |

| $101 - $200 Premium | 300 | 10% |

| Greater than $200 Premium | 61 | 2% |

| Null Premium Value | 6 | 0% |

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare Plan Finder and Landscape Source Files; excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

Plan Competition for 2019

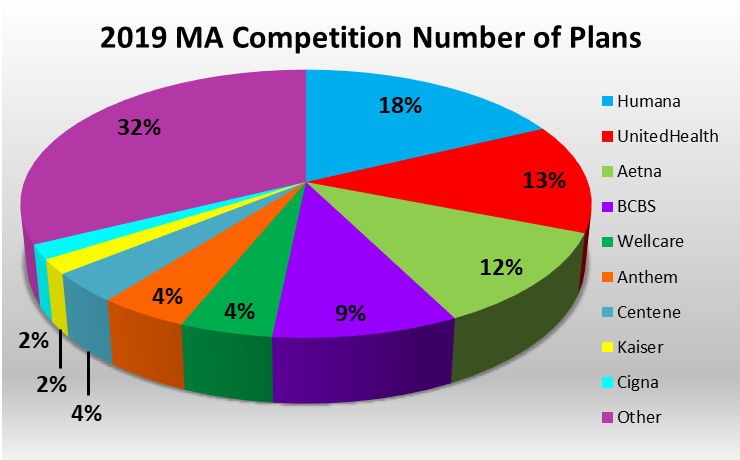

Based on the 2019 CMS Landscape reports, Humana continues to market more MA plans than any other company nationwide, with 548 distinct plans identified in MFA’s assessment. UnitedHealth continued to increase its MA plan offerings for the 2019 calendar year with 406 distinct plans identified, up 62 plans from last year. Aetna (including Coventry and other affiliates) is offering 355 plans for 2019. Anthem and the vast majority of other Blue Cross Blue Shield plans as well as WellCare and Centene also continue to have a notable plan offerings presence, respectively.

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Plan Finder and Landscape Source Files; excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

Medicare Benefits AnalyzerTM for Comparing Medicare Benefits

Analysts often use Plan Finder benefits data from the Medicare.gov website to compare plan premiums, copays and star rating awards, market by market. Identifying plan-by-plan benefits details such as annual Out-of-Pocket Limits and Deductibles; Primary Care Doctor Visit Copays; Specialist Doctor Visit Copays; Inpatient Hospital Copays; Ambulance and Emergency Room Copays; and Drug Tier Copays helps companies to assess competitive advantages across markets. This type of comparative analysis provides invaluable intelligence that prepares Medicare plans to promote and sell their products.

In order to help Medicare plans access and use Medicare Plan Finder (MPF) data more efficiently, Mark Farrah Associates (MFA) maintains this data in its Medicare Benefits AnalyzerTM product. 2019 Plan Finder data is online now along with Star Quality Ratings to complement the benefits detail. Subscribers may query tables presenting plan benefit comparisons by state and county or download large datasets using the file export interface. Subscribers also have access to Medicare Business Online™ for tracking month-to-month Medicare Advantage and Prescription Drug Plan enrollment changes. Visit our website at www.markfarrah.com or call 724-338-4100 for more information.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a free monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section in the grey area at the bottom of the page.

Request Information

within 1-2 business days.