Individual Health Insurance Enrollment Trends and Market Insights

July 30, 2020

According to financial statements filed by insurers and estimates by Mark Farrah Associates, enrollment in individual, non-group medical plans, both on and off the exchange, totaled approximately 14.9 million as of March 31, 2020. In addition, the Centers for Medicare & Medicaid Services (CMS) reported in the Health Insurance Exchanges 2020 Open Enrollment Report that approximately 11.4 million consumers enrolled in Marketplace plans following the 2020 open enrollment period (OEP). This includes more than 8.3 million enrolled in the 38 states using the HealthCare.gov platform and 3.1 million enrolled in the remaining State-Based Marketplaces. In this brief, Mark Farrah Associates (MFA) provides insights into individual health insurance enrollment trends and market developments with state-by-state membership comparisons.

In March 2020, health insurers reported total individual, non-group coverage for approximately 14.9 million people, based on statutory financial statements filed with state regulators and the NAIC (National Association of Insurance Commissioners) and the CA DMHC (California Department of Managed Health Care). This represents a 1.43% decline from the 15.2 million members in March 2019. Although the individual segment experienced a slight year-over-year decline in enrollment, some providers increased in membership. Centene’s enrollment grew by 12.7% since March 2019 and remains the segment leader. Anthem’s individual enrollment remained relatively the same between 1Q19 and 1Q20 and continues to hold the fourth spot for the third year. Guidewell Mutual Holding Group (Florida BCBS) and Kaiser Foundation Group both experienced minor enrollment declines.

Individual Segment - Members |

|||||

Company |

1Q19 |

4Q19 |

1Q20 |

||

|

Centene |

2,008,757 |

1,831,458 |

2,263,435 |

||

|

Guidewell Mutual (BCBS of FL) |

1,249,945 |

1,141,525 |

1,249,772 |

||

|

Kaiser |

1,193,147 |

1,035,223 |

1,112,825 |

||

|

Anthem |

1,062,308 |

989,715 |

1,067,570 |

||

Source: Health Coverage Portal™, Mark Farrah Associates, presenting data from NAIC, CA DMHC

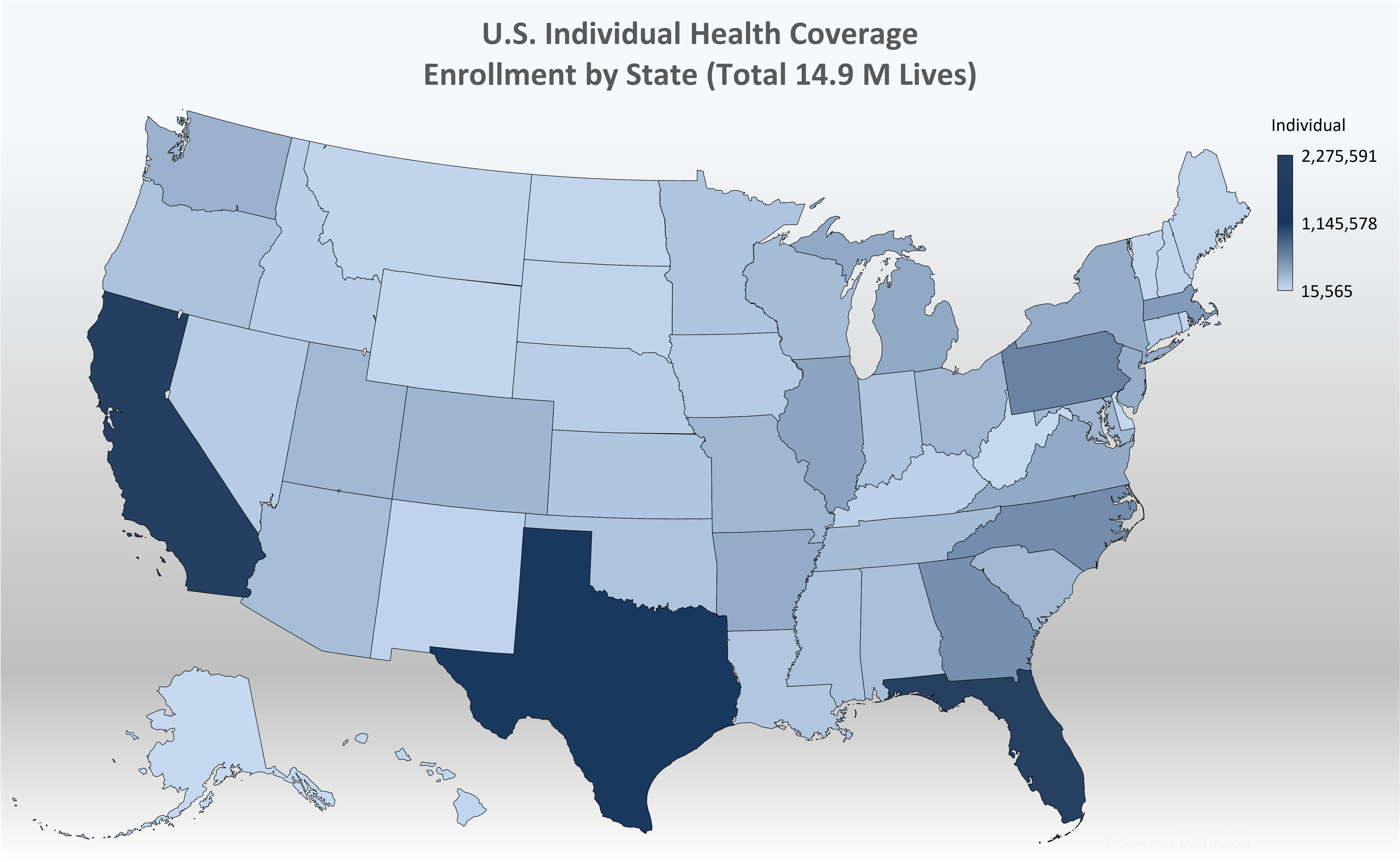

As indicated in the heat map below, California, Florida, and Texas had the highest number of enrollees, with Florida covering nearly 2.3 million members as of 1Q20. It is important to note that Mark Farrah Associates (MFA) applied enrollment figures for select carriers not required to report health enrollment on a quarterly basis and made other adjustments based on market analysis. Furthermore, individual enrollment includes short term plan enrollees and may include Medicaid programs, such as CHIP, as some states include subsidized lines in the individual segment. These factors may have resulted in moderate understatement or overstatement of enrollment.

Source: Health Coverage Portal™, Mark Farrah Associates, presenting data from NAIC, CA DMHC and CMS

The following table presents state-by-state breakdowns of the total individual market, separating on and off-exchange membership. For this assessment, MFA applied the assumption that the difference between total individual enrollment reported by carriers and on-exchange, Marketplace enrollment reported in CMS’s Open Enrollment Period (OEP) public use files is a reasonable representation of off-exchange membership. This analysis did not include state-by-state research to provide local market insights about exchange positioning nor did the analysts investigate off-exchange plan options. Nonetheless, the state breakdowns provide a framework for understanding greater market opportunity. These figures indicate 76% of individual medical members were enrolled through Marketplace plans and 24% were enrolled in off-exchange plans.

|

State |

March 2020 Total Individual Enrolled |

2020 On-Exchange Enrolled |

Estimated Off-Exchange Enrolled |

|

AK |

15,565 |

17,696 |

0 |

| AL |

190,821 |

160,429 |

30,392 |

| AR |

329,950 |

64,360 |

265,590 |

| AZ |

205,483 |

153,020 |

52,463 |

| CA |

2,228,098 |

1,538,819 |

689,279 |

| CO |

266,531 |

166,852 |

99,679 |

| CT |

117,651 |

107,833 |

9,818 |

| DC |

30,335 |

17,538 |

12,797 |

| DE |

26,572 |

23,961 |

2,611 |

| FL |

2,275,591 |

1,913,975 |

361,616 |

| GA |

521,781 |

463,910 |

57,871 |

| HI |

36,656 |

20,073 |

16,583 |

| IA |

113,662 |

54,586 |

59,076 |

| ID |

91,155 |

78,431 |

12,724 |

| IL |

384,564 |

292,945 |

91,619 |

| IN |

160,626 |

140,931 |

19,695 |

| KS |

152,910 |

85,837 |

67,073 |

| KY |

72,714 |

83,139 |

0 |

| LA |

143,435 |

87,748 |

55,687 |

| MA |

442,617 |

319,612 |

123,005 |

| MD |

257,504 |

158,934 |

98,570 |

| ME |

62,681 |

62,031 |

650 |

| MI |

348,793 |

262,919 |

85,874 |

| MN |

161,341 |

110,042 |

51,299 |

| MO |

256,635 |

202,750 |

53,885 |

| MS |

175,103 |

98,892 |

76,211 |

| MT |

49,377 |

43,822 |

5,555 |

| NC |

542,932 |

505,275 |

37,657 |

| ND |

39,112 |

21,666 |

17,446 |

| NE |

97,334 |

90,845 |

6,489 |

| NH |

49,973 |

44,412 |

5,561 |

| NJ |

319,358 |

246,426 |

72,932 |

| NM |

50,965 |

42,714 |

8,251 |

| NV |

110,959 |

77,410 |

33,549 |

| NY |

325,575 |

272,948 |

52,627 |

| OH |

255,234 |

196,806 |

58,428 |

| OK |

164,892 |

158,642 |

6,250 |

| OR |

181,034 |

145,264 |

35,770 |

| PA |

609,341 |

331,825 |

277,516 |

| RI |

45,516 |

34,634 |

10,882 |

| SC |

251,208 |

214,030 |

37,178 |

| SD |

56,228 |

29,331 |

26,897 |

| TN |

221,662 |

200,445 |

21,217 |

| TX |

1,332,273 |

1,116,293 |

215,980 |

| UT |

247,347 |

200,261 |

47,086 |

| VA |

338,544 |

269,474 |

69,070 |

| VT |

32,207 |

27,335 |

4,872 |

| WA |

288,408 |

212,188 |

76,220 |

| WI |

222,025 |

195,498 |

26,527 |

| WV |

21,549 |

20,066 |

1,483 |

| WY |

31,587 |

24,574 |

7,013 |

| Total |

14,953,414 |

11,409,447 |

3,543,967 |

Source: Health Coverage Portal™, Mark Farrah Associates, presenting data from NAIC, CA DMHC and CMS

Individual Financial Performance

Despite facing steady declines in enrollment, the individual segment has sustained a three-year period of profitability. According to our strategy brief, “A Brief Analysis of Profitability Trends for the 2019 Individual and Small Group Health Insurance Markets,” plans reported a healthy underwriting gain of $4.2 billion. However, 2019 marked the first time since 2015 where the growth in medical claims expenses outpaced that of premiums on a per member per month basis.

In 2019 approximately 68% of insurers reported a net underwriting gain for the individual segment, down from 73% of plans in 2018. Insurers collectively gained nearly $4.2 billion in the segment last year; a significant decrease from the $7.9 billion reported in 2018. On an aggregate basis, individual business summed to a net underwriting gain in 43 states. Florida generated the largest total profit, with plans reporting a combined net gain of over $1.1 billion. Pennsylvania and North Carolina reported underwriting gains greater than $200 million each. Massachusetts led the country in net underwriting loss, totaling nearly $58 million, followed by New York and Indiana. Take into consideration, these performance indicators include business generated both on and off exchange.

After years of robust premium growth leading to three consecutive years of overall segment profitability, plans in the individual segment for 2020 are reporting a 2% growth overall in premiums per member per month (PMPM), matching that of the growth seen in 2019. So far in 2020 the increase in premium PMPM has been outpaced by increased medical expenses PMPM. These two factors have resulted in an increased Medical Expense Ratio in 1Q20, which illustrates the amount of spending on medical costs as a percentage of premiums earned. NAIC reporting health companies reported an aggregate medical expense ratio for the individual segment of 73.8% in 1Q20, up from 72.1% in 1Q19. In a normal year, the first quarter increase in the medical expense ratio would signal lower levels of profitability for the segment in 2020. However, 2020 is not a normal year, and the impacts of COVID 19 are not reflected in the first quarter financial reporting. Therefore, it is possible that health insurance companies will report lower medical expenses for the second quarter.

Conclusion

The individual market continues to face hefty challenges especially amidst the current socio-economic implications of the coronavirus outbreak. However, while individual health insurance business has been experiencing enrollment declines, plans reported a healthy net underwriting gain of $4.2 billion in 2019. Open enrollment for 2021 coverage starts on Nov. 1st and runs through Dec. 15th, although some states, including New York, California and Massachusetts have permanently extended their open enrollment periods. It is likely the individual segment may experience significant impacts of the pandemic and current economic crisis. As we await data from the remaining quarters of 2020 and health companies begin to finalize premium rates in preparation for 2021, Mark Farrah Associates will continue to report on important developments and performance metrics.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health PLUS, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.