Health Insurance Enrollment Trends for Year-End 2018

May 1, 2019

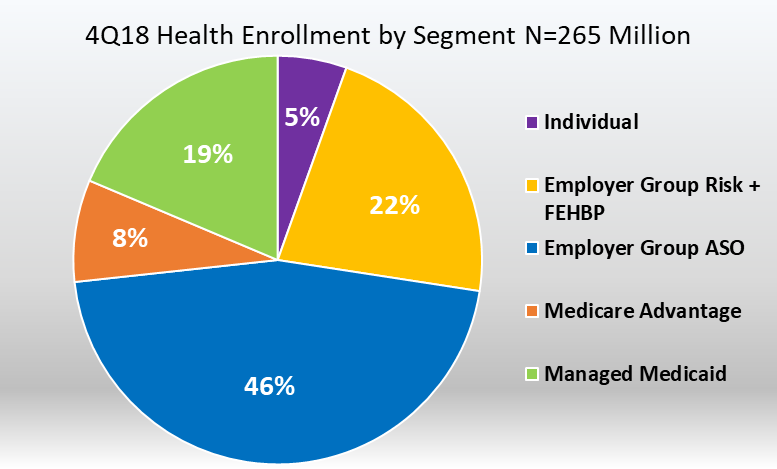

Mark Farrah Associates (MFA) assessed the latest year-over-year enrollment trends, comparing fourth quarter 2017 with fourth quarter 2018 segment membership based on data filed in statutory financial reports from the NAIC (National Association of Insurance Commissioners) and the CA DMHC (California Department of Managed Health Care). As of December 31, 2018, almost 265.2 million people received medical coverage from U.S. health insurers. This number is down from 265.6 million, or approximately 428,000 members, from a year ago. Year-end enrollment trends indicate membership gains for Medicare Advantage (MA) and Employer Group administrative services only (ASO) business while the managed Medicaid market, Individual, and Employer Group Risk segments experienced year-over-year declines.

Segment by Segment Enrollment Trends

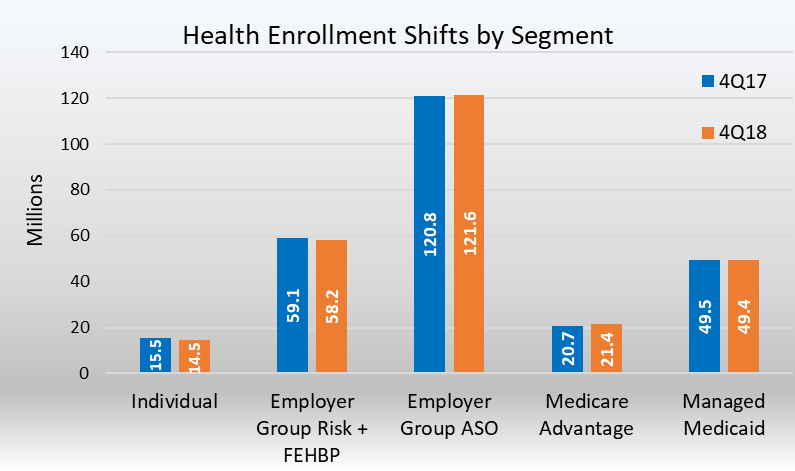

As of December 31, 2018, the Individual segment lost over 1.0 million members year-over-year (YOY) and the Employer Group Risk segment, including Federal Employees Health Benefit Plans (FEHBP) business, experienced a decline of approximately 897,000 members. The Employer Group ASO segment persisted as the largest source of coverage in the industry, enrolling nearly 121.6 million people. Medicare Advantage experienced moderate growth in membership as over 736,000 more seniors chose an MA plan YOY. Managed Medicaid saw a slight decrease YOY, by more than 36,000 members. A more in-depth look at each segment follows.

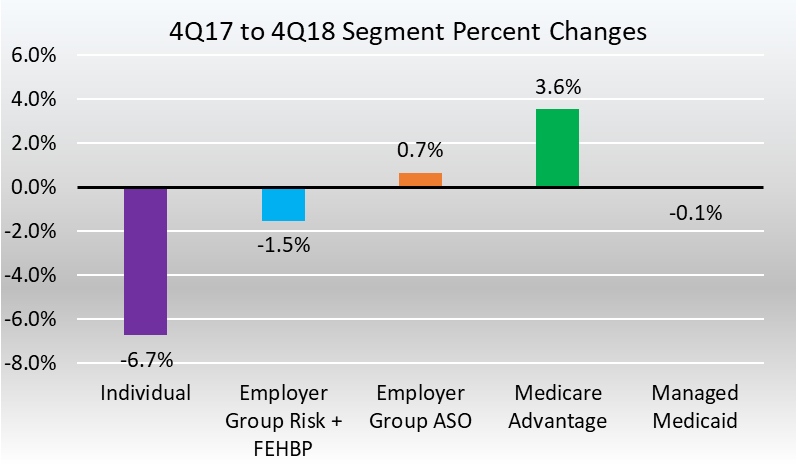

- The Individual segment experienced a significant decline of 6.7% from 15.5 million in December 2017 to 14.5 million in December 2018. Some factors that have led to a decrease in the individual market include increased costs for providers, increased premiums for members, and the repeal of the Affordable Care Act’s (ACAs) individual mandate.

Source: Health Coverage Portal TM, Mark Farrah Associates

- Managed Medicaid membership marginally declined by 0.1%, or approximately 36,000 enrollees between December 31, 2017 and December 31, 2018. Despite the decline in membership, Medicaid continues to be the largest government-sponsored health program in the United States, measured by enrollment.

- Medicare Advantage (MA) enrollment increased from 20.7 million as of December 31, 2017 to 21.4 million at year-end 2018 according to plan-reported statutory reports. The MA segment remained the segment leader in terms of percentage increases – consistently growing YOY.

Source: Health Coverage Portal TM, Mark Farrah Associates

- Employer Group Risk membership, including Federal Employees Health Benefit Plans (FEHBP) membership, experienced a 1.5% decline between 4Q17 and 4Q18. This equates to a segment decrease of over 897,000 as more employers continue to shift towards self-funded (ASO) insurance for their employees.

- Employer group ASO (administrative services only for self-funded business) membership grew by over 814,000 members from December 2017 to December 2018. YOY, the increase was 0.7%, nearly offsetting the decrease in the Employer Group Risk decline at a one-to-one ratio. MFA identified 121.6 million ASO covered lives, which encompassed 46% of total health enrollment by segment for 4Q18.

Source: Health Coverage Portal TM, Mark Farrah Associates

Conclusion

As of December 31, 2018, almost 265.2 million people received medical coverage from U.S. health insurers, down approximately 428,000 members from a year ago. Year-end enrollment trends indicate membership declines for a majority of the health care segments. Health care will continue to be subjected to regulatory and political pressure as the upcoming presidential election approaches.

The Individual market continues to be the most volatile health care segment. Repealing the ACA remains a controversial topic that is gaining steam as 2020 swiftly approaches. While there has yet to be a popular front runner in terms of a conservative replacement plan, Medicare for All is a progressive replacement plan that aims for public sector health insurance. In addition, managed Medicaid has expanded under the ACA but recently work requirements have gained popularity. Managed Medicaid work requirement waivers have already been approved or are currently pending in 15 states. Currently, 37 states including the District of Columbia have chosen to expand their Medicaid programs. Although Montana is counted in the 37 expanded states, a bill is currently being discussed that would extend the current expansion cutoff date past June 30, 2019.

About the Data

The data used in this analysis brief was obtained from Mark Farrah Associates' Health Coverage Portal™ database. It is important to note that MFA estimated fourth quarter 2018 enrollment for a small number of health plans that are required to report quarterly enrollment but hadn’t yet filed. Employer group ASO figures may be estimated by Mark Farrah Associates using credible company and industry resources. Individual, Non-Group membership reported by some carriers may include CHIP (Children’s Health Insurance Program).

These adjustments may have resulted in moderate understatement or overstatement of enrollment changes by segment. Findings reflect enrollment reported by carriers with business in the U.S. and U.S. territories. Data sources include NAIC (National Association of Insurance Commissioners) and the CA DMHC (California Department of Managed Health Care). As always, MFA will continue to report on important plan performance and competitive shifts across all segments.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.