Continued Year-Over-Year Growth for Medicare Supplement Plans

May 29, 2020

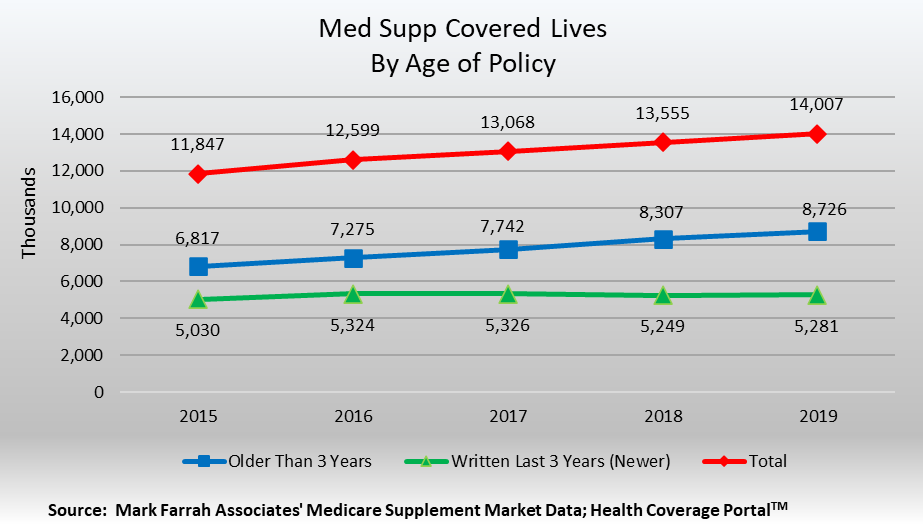

As of December 31, 2019, the Medicare Supplement market (also known as Med Supp or Medigap) experienced yet another year of membership growth. Based on performance data filed in annual financial statements from the NAIC (National Association of Insurance Commissioners), enrollment in Medicare Supplement plans was over 14 million, up 3.33% year-over-year. Mark Farrah Associates (MFA) identified 198 distinct carriers that filed annual data with the NAIC. Breakdowns of in-force policies show that carriers issued policies to almost 5.28 million new members written in the last three years. Carriers reported an aggregate of 8.7 million members covered by older policies that had been issued prior to the year 2017. This brief provides an overview of the Medicare Supplement market with insights about competitive positioning and standardized plan type preferences.

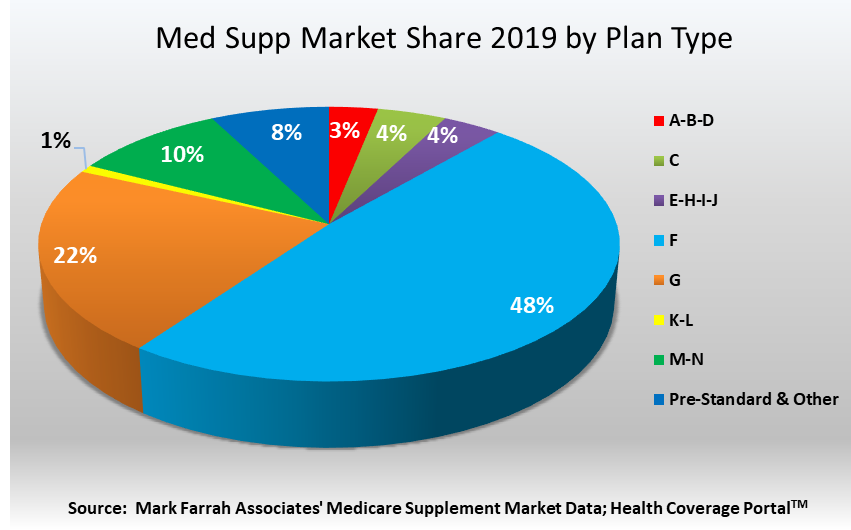

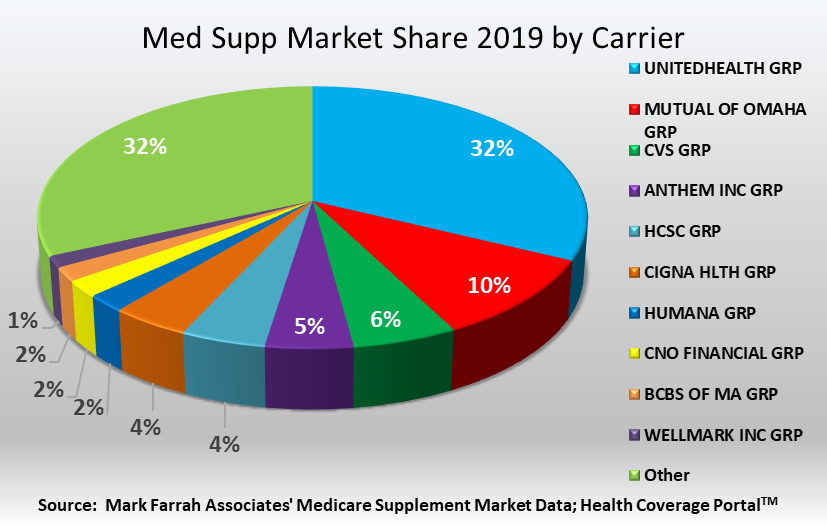

Medicare Supplement carriers added approximately 452,000 covered lives to their portfolios between December 31, 2018 and December 31, 2019. About 32% of this growth was captured by UnitedHealth Group. Among standardized plans A-N, Plan F covers the annual Medicare Part B deductible and offers the most comprehensive benefits. Although Plan F enrolled almost 6.8 million Med Supp members and accounted for over 48% of the market in 2019, this was a decrease of nearly 244,000 members year-over-year from 2018. This decline in Plan F membership is largely due to a provision in the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) whereby supplemental plans covering the Part B deductible can no longer be purchased. On January 1, 2020, Plan F (and Plan C) ceased to be an option for newly eligible Medicare enrollees. This policy change has caused a shift in growth from Plan F to Plan G. Plan G provides a high-deductible option for new beneficiaries and continued to experience year-over-year increases, notably enrolling 761,500 new members.

**Note plan type “P” for Pre-Standardized is used for policies issued prior to the enactment of the Omnibus Reconciliation Act (OBRA) of 1990, which standardized benefits for Medicare Supplement plan types. Plan type “O” or “Other” is used by carriers in a few states including Massachusetts, Minnesota, and Wisconsin that receive waivers to the standardized Medicare Supplement regulations.

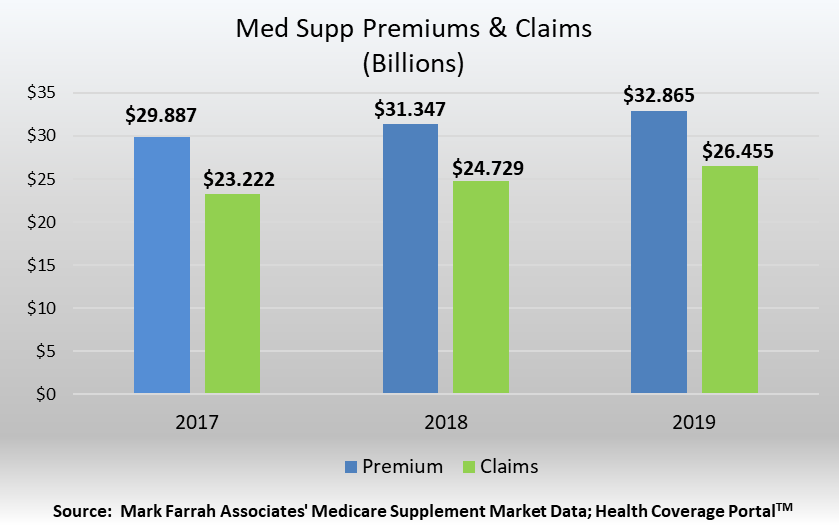

Med Supp plans collectively earned approximately $32.9 billion in premiums and incurred $26.5 billion in claims during 2019, a slight increase from 2018. The aggregate loss ratio (incurred claims as a percent of earned premiums) was 80.5% in 2019, an increase from 78.9% in 2018.

The top 10 companies in the Med Supp arena comprise 68% of the market with approximately 9.6 million members. UnitedHealth, with its longstanding contract with AARP, continued to command 32% of the market with more than 4.5 million members. Mutual of Omaha ranked second with 10% market share and approximately 1.4 million members as of December 31, 2019. CVS, formerly Aetna, was the third largest plan in 2019, with over 770,000 enrolled. Anthem ranked fourth with over 643,000 members. HCSC and Cigna experienced year-over-year growth, both surpassing 580,000 members enrolled.

The growing U.S. senior population continues to present increasing opportunities for health insurers offering Medicare Supplement plans. Insurers continue to diversify their senior market portfolios to leverage opportunities across all product lines and expand product options to keep up with industry trends. Mark Farrah Associates will continue to monitor enrollment and plan performance in this competitive segment.

About Med Supp Market Data

Med Supp Market Data, a subscription option through Mark Farrah Associates’ Health Coverage Portal™, presents the latest market share and financial performance data for Medicare Supplement plans. The product includes state-by-state membership, premiums, claims and loss ratios for plans nationwide. Online tables also include claims contacts as reported in the financial statements as filed with the National Association of Insurance Commissioners (NAIC). California managed care plans do not file financial statements with the NAIC and are not included in this analysis. For more information about Med Supp Market Data, please visit our website or call 724.338.4100.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, Health Plans USA™ and 5500 Employer Health Plus TM. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.