A Brief Look at Commercial Health Insurance Market Share in Select New York Metro Areas

March 1, 2018

Health plan enrollment and market share data are important metrics for health insurers to assess in order to identify opportunities and make better business decisions about products and services. Companies not only look at their own market position but also routinely analyze competitor membership to evaluate relative market share. Enrollment in core markets, commercial health insurance, and government-sponsored programs is often further segmented for analysis based on available data.

Insurance companies provided medical coverage for approximately 264 million people, based on September 30, 2017 enrollment as reported in Mark Farrah Associates’ Health Coverage Portal TM. The employer-based ASO and risk-based segments remained the largest sources of coverage in the industry, collectively enrolling 195 million people in the commercial segment. Additionally, Medicaid and SCHIP membership nearly rose to 74 million people with approximately 50 million beneficiaries enrolled in managed care plans. Furthermore, approximately 58.8 million seniors were enrolled in Medicare programs at the end of third quarter 2017, including more than 38.4 million people with original Medicare and 20 million Medicare Advantage members.

This brief presents an overview of market demographics and commercial market share data with a focus on health plan market position in three metropolitan statistical areas (MSAs) in New York.

Competition and Market Share

To analyze health insurance competition, analysts often start with state-by-state assessments of competitor enrollment and market share. Data from statutory filings can provide valuable insights about state health insurance competition. Based on data filed in statutory financial reports from the NAIC (National Association of Insurance Commissioners) and the CA DMHC (California Department of Managed Health Care), Mark Farrah Associates’ Health Coverage PortalTM is a tool widely used by health plans for easy access to market share data and financial performance metrics.

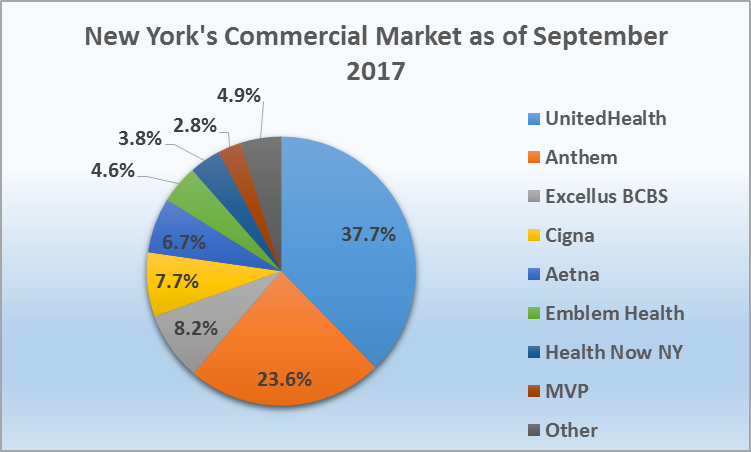

For the purposes of this brief, MFA first looked at the competitive mix in New York’s commercial market by analyzing state enrollment figures from the Health Coverage PortalTM. The chart below illustrates the leading companies in New York’s commercial health insurance market. UnitedHealth and Anthem comprise the largest percentage of market share for the state.

While state level market share is an important metric, industry analysts often need to assess market share at the county or metropolitan statistical area (MSA) level in order to gain a more complete competitive picture of the market. However, drilling down to county market share can be challenging for analysts because county level enrollment is not generally reported in statutory filings. State-wide commercial market share percentages often do not accurately represent the true distribution of plan activity across a state. For this reason, further analysis at the county or MSA level is often necessary for a more thorough representation of the market share in any given state. Mark Farrah Associates’ County Health CoverageTM is a tool used to assess reliable estimates of health insurance enrollment and market share at the county and metropolitan statistical area level.

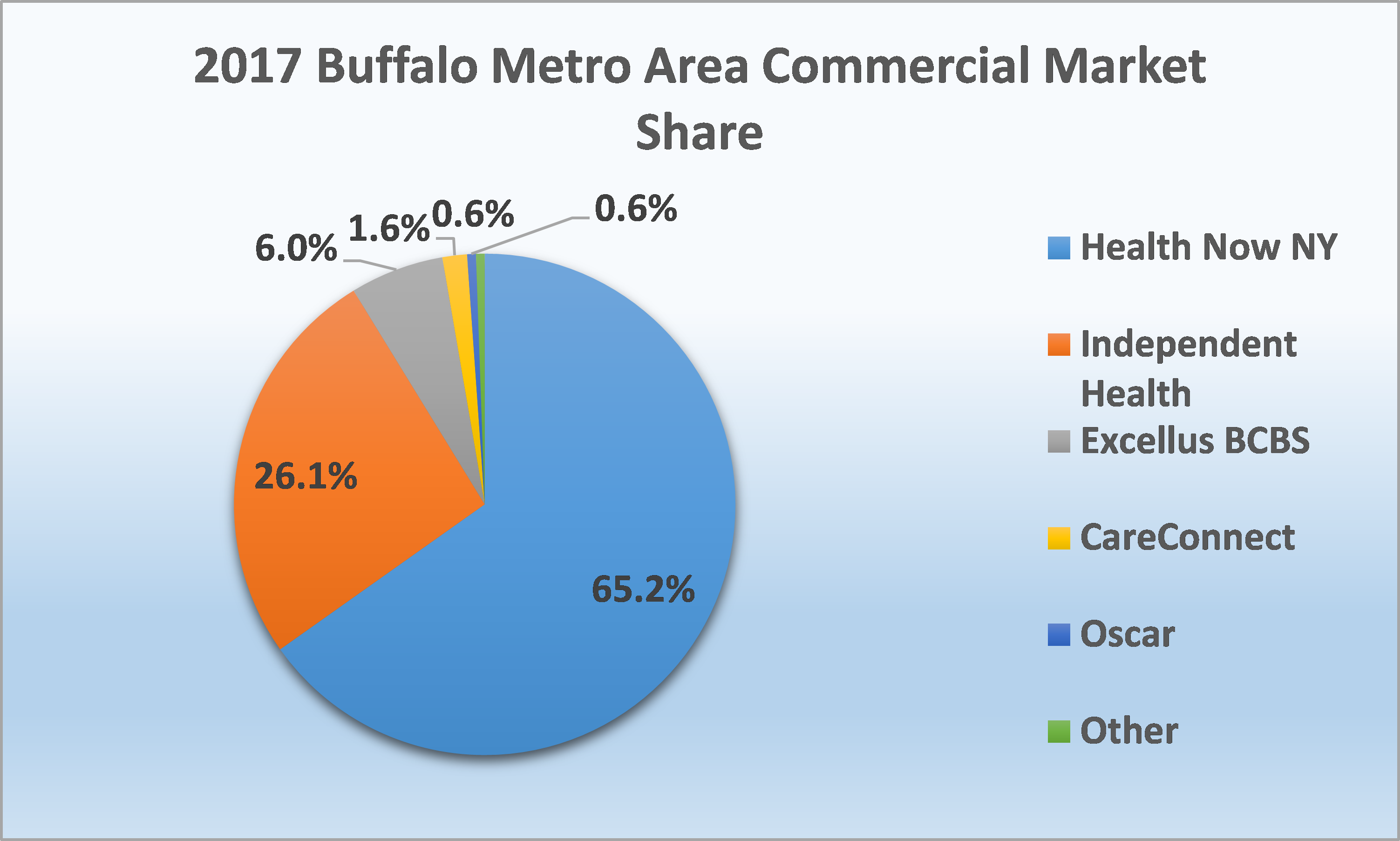

Source: County Health Coverage™, Mark Farrah Associates™

- The top three MSAs in New York are New York City, Buffalo, and Rochester. Working west to east, the Buffalo’s metropolitan region, with a population of approximately 1.14 million people, is the second largest MSA in the state. Based on MFA’s county estimates, the above chart provides an illustration of market share for the greater Buffalo region. Health Now NY & Independent Health command 65.2% and 26.1% of the market with only a small percentage left to be shared by a handful of other plans.

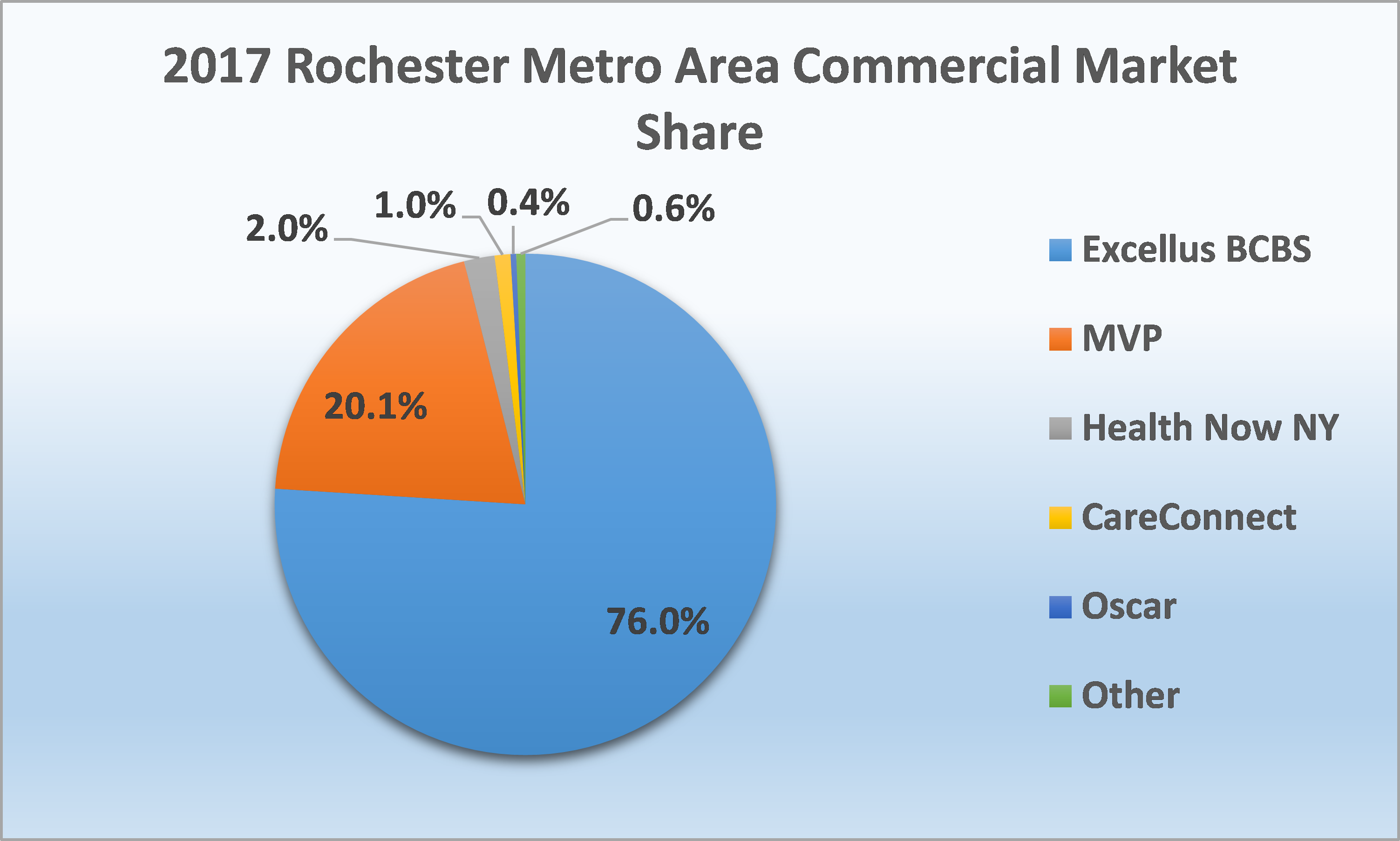

Source: County Health Coverage™, Mark Farrah Associates™

- Slightly north and east of Buffalo, the Rochester metropolitan area with a population of 1.08 million people is the third largest MSA in the state. Based on MFA’s county estimates, the region is dominated by Excellus Health with 76% of the market and MVP with 20.1 percent.

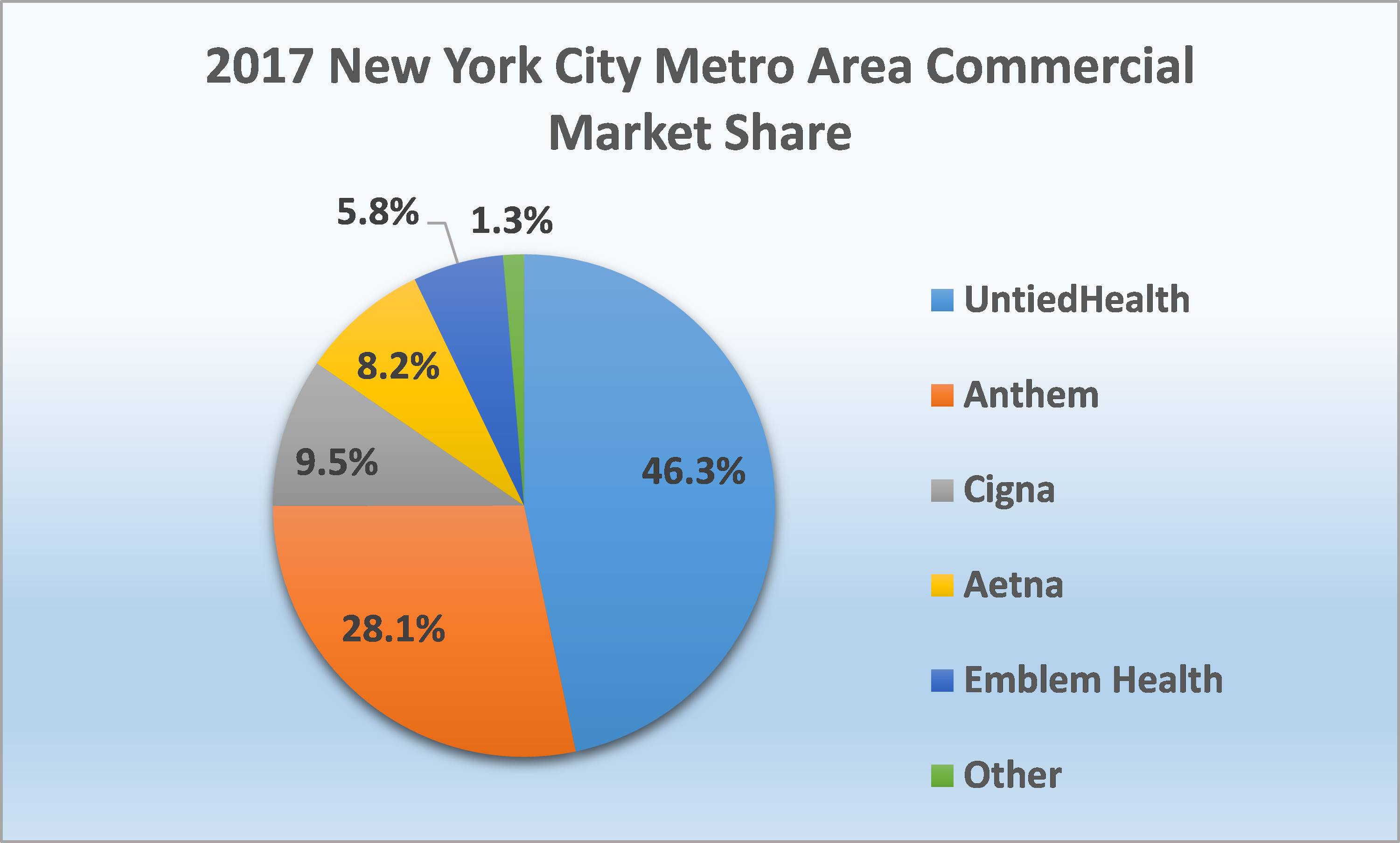

Source: County Health Coverage™, Mark Farrah Associates™

- The largest MSA is the New York City metropolitan area, with a NY population of nearly 13.4 million people. Based on MFA’s county estimates, the above chart shows that UnitedHealth and Anthem are the commercial market leaders for the New York City MSA region.

Commercial market share assessment at the county level can be particularly difficult because insurance companies, with the exception of some HMO plans, are generally not required to report local market membership except when mandated by state or federal regulation. The New York MSA market data, as illustrated in this brief, demonstrates the importance of analyzing county and metropolitan statistical area market share for business planning and marketing strategy. The source used for this analysis of commercial market share in New York was MFA’s County Health CoverageTM product. It is important to note that in some cases, estimates were based on enrollment reported by employer contract situs rather than state of member residence.

About County Health Coverage TM

County Health Coverage™ provides reliable estimates of health insurance enrollment and market share at the state, county and metropolitan statistical area (MSA) level. Product features include company market share by county, company and state for the Private Risk, Private ASO, Managed Medicaid, Medicare Advantage, and PDP segments. Breakdowns by product type (HMO, PPO, etc.) are also presented as well as population demographics and interactive, visual mapping tools. To learn more, visit the product page - County Health Coverage TM.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading provider of health plan market data and analysis tools for the healthcare industry. If your company relies on accurate assessments of health plan market share to support business planning, we encourage you to contact us to learn more about our products. Our portfolio includes Health Coverage Portal™, County Health Coverage TM, Medicare Business Online™, Medicare Benefits Analyzer™ and Health Plans USA™ - - www.markfarrah.com.

Healthcare Business Strategy is a free monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section in the grey area at the bottom of the page.

Request Information

within 1-2 business days.