Year-Over-Year Health Insurance Enrollment Trends Amidst a Pandemic-Era

April 30, 2021

As U.S. health insurers continue to navigate the rough waters of the ever-changing healthcare landscape, most carriers remain resilient amid the adverse economic impact brought forth by the pandemic. The effects of COVID-19 have certainly been felt by consumers and businesses, but the full repercussions on the health insurance industry may not be completely realized for quite some time. Nonetheless, health insurers persevere with increasing efforts to improve health care delivery by providing access to affordable healthcare, expanding choices and service options, and propelling competition and innovation.

Market analysts throughout the industry rely on enrollment data and segment performance metrics to gain better insights into health plan market share and competitive positioning. Mark Farrah Associates (MFA) assessed the latest year-over-year enrollment trends, comparing fourth quarter 2019 with fourth quarter 2020 segment membership. This assessment is based on data filed in statutory financial reports from the NAIC (National Association of Insurance Commissioners), the CA DMHC (California Department of Managed Health Care), CMS (Centers for Medicare and Medicaid Services) and various state agencies.

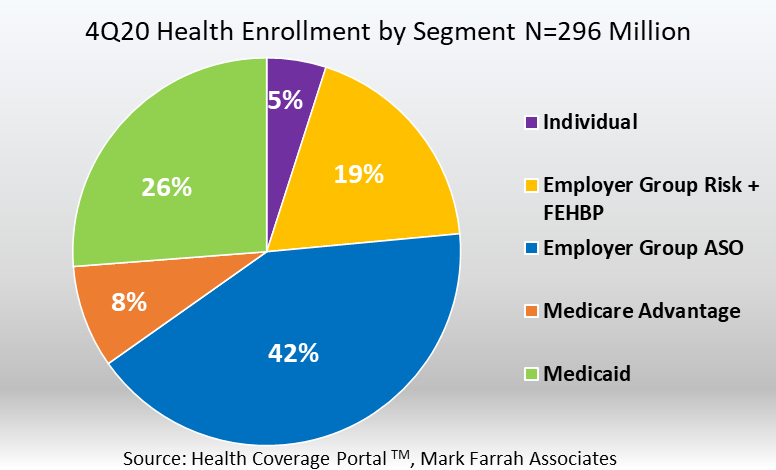

As of December 31, 2020, approximately 296 million people received medical coverage from U.S. health insurers. This number is up from 288 million, or approximately 7.4 million additional members, from a year ago. Between 4Q19 and 4Q20, membership growth was significant in Medicare Advantage as this segment gained approximately 2 million more members, year-over-year. In addition, the individual health insurance market and Medicaid also experienced marked membership increases. The Employer-group ASO (administrative services only for self-funded plans) and Employer-group risk segments provide the largest sources of coverage in the industry, however, both segments continued to demonstrate year-over-year decreases in enrollment.

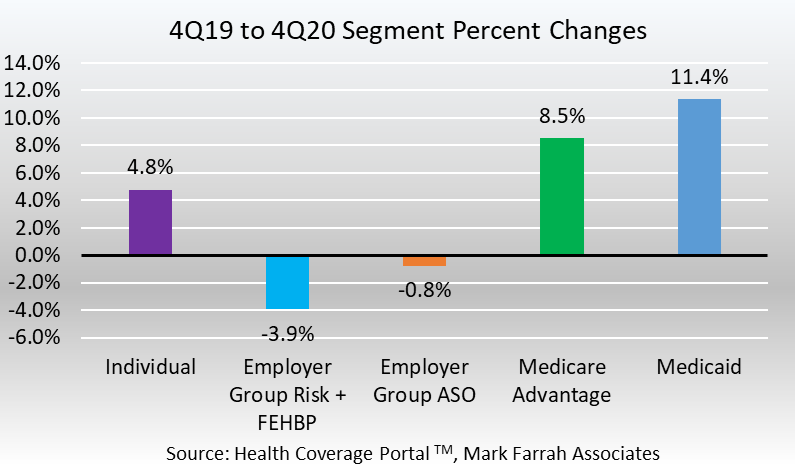

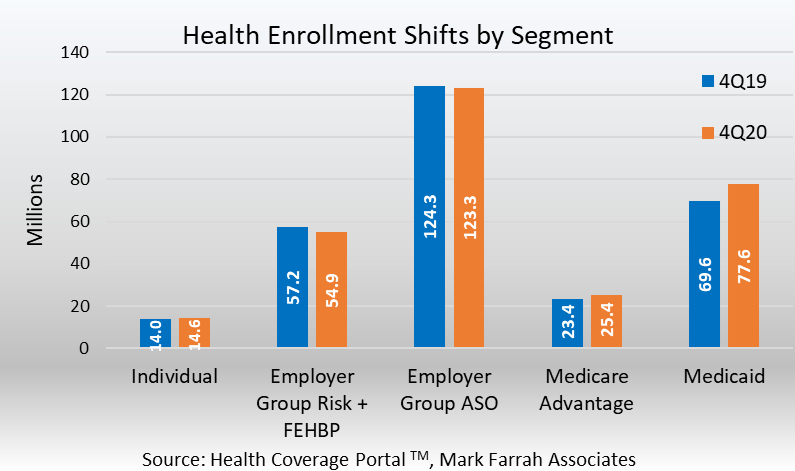

- Individual business experienced an enrollment increase from December 31, 2019 and December 31, 2020. Total year-over-year membership for this segment grew 4.8% from 13.9 million enrollees to approximately 14.6 million. This is an increase of over 660,000 members. The increase, most likely caused by an influx of members who lost employer sponsored health coverage due to the economic downturn caused by COVID-19, marks the first year-over-year increase since the segment reached its peak in 2015.

- Approximately 77.5 million beneficiaries received healthcare through Managed Care Organizations (MCOs) and Fee-for-Service type Medicaid programs as of December 31, 2020. This is an 11.4% increase from December 2019, based on membership filed in statutory financial reports from the NAIC and the CA DMHC, as well as state reported Medicaid and CMS reported Medicaid enrollment reports. The surge of Medicaid enrollment brought on by poor economic conditions set a new enrollment record for Medicaid in 2020 and marked the first year-over-year increase since 2016. Note: a portion of CHIP (Children’s Health Insurance Program) enrollment is reported in the Individual segment within statutory reporting.

- Enrollment in Medicare Advantage (MA) continues to grow at a steady rate as more and more Americans of the Baby Boom generation are entering retirement. Yet, only 43% of the nearly 63 million people eligible for Medicare are enrolled in a MA, thus providing ample opportunity for health insurers with MA business. Fourth quarter 2020 Medicare Advantage membership stood at 25.3 million, a year-over-year increase of nearly 2 million members, representing 8.5% growth.

- Employer-groups continue to be the leading source of health coverage in the U.S. However, year-end figures indicated Employer-group risk membership, including Federal Employees Health Benefit Plans (FEHBP), experienced a significant decrease between 4Q19 and 4Q20. Membership for the Employer-group risk segment was 54.9 million as of December 31, 2020, a year-over-year decline of 2.2 million people. This is partly due to pandemic-related unemployment.

- Employer-group, self-funded contracts continue to remain popular amongst employers as they can be more cost effective than risk-based plans. Self-funding is specifically common among larger companies as they can disperse the risk of exorbitant claims over many workers and their dependents. According to MFA’s recent estimates, Employer-group ASO (administrative services only for self-funded business) membership was approximately 123 million. This was a decrease of almost 935,000 members from December of 2019 and marked the first year-over-year decline in the past ten years. Membership for this segment encompassed 41.7% of total health enrollment for 4Q20, as self-funded ASO plans continue to be a viable option for businesses.

With some of the Coronavirus pandemic headwinds being felt already, the market outlook remains unpredictable. Many insurers are still reporting strong numbers; however, patients are now playing catch-up with their healthcare journey, thus providing uncertainty around the costs involved to pay for such claims. This, in turn, could potentially increase premiums and impact enrollment in the future. Only time will tell the outcome, as the health insurance industry continues to experience a period of unrest. Mark Farrah Associates will continue to monitor enrollment changes and competitive shifts across all healthcare segments, as the need for market share and financial performance data continues to be in high demand.

About the Data

The data used in this analysis brief was obtained from Mark Farrah Associates' Health Coverage Portal™ database. It is important to note that MFA estimated fourth quarter 2020 enrollment for a small number of health plans that are required to report quarterly enrollment but hadn’t yet filed. Employer group ASO figures may be estimated by Mark Farrah Associates using credible company and industry resources. Individual, Non-group membership reported by some carriers may include CHIP (Children’s Health Insurance Program). These adjustments may have resulted in moderate understatement or overstatement of enrollment changes by segment. Findings reflect enrollment reported by carriers with business in the U.S. and U.S. territories. Data sources include NAIC (National Association of Insurance Commissioners),the CA DMHC (California Department of Managed Health Care), CMS (Centers for Medicare and Medicaid Services) and various state agencies. As always, MFA will continue to report on important plan performance and competitive shifts across all segments.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health PLUS, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.