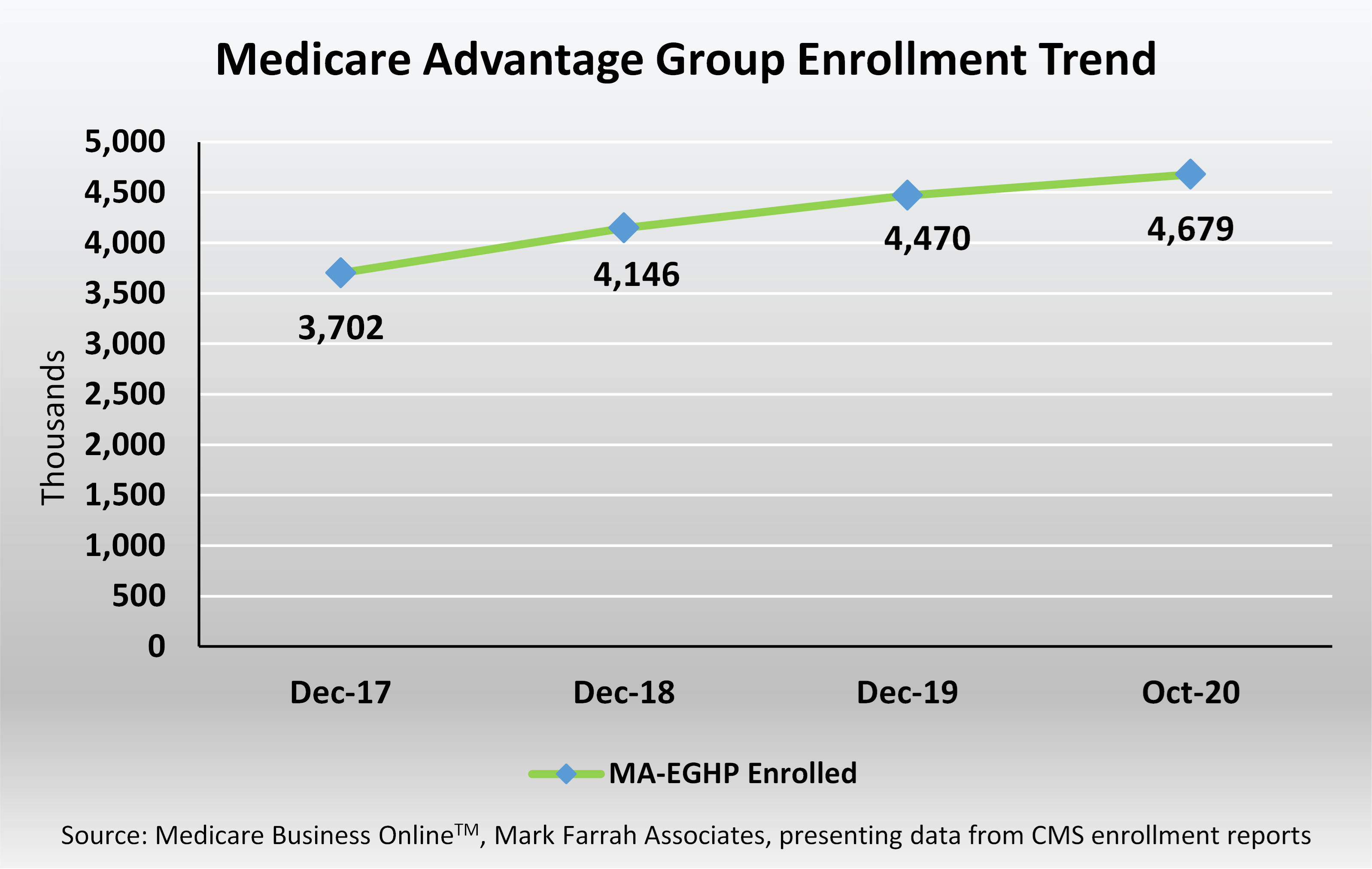

Employer-Group Medicare Advantage Enrollment Increased 26% Over 4-Year Period

November 17, 2020

Nearly 25.4 million people were enrolled in Medicare Advantage (MA) plans as of October 1, 2020, representing a growing share of the 62.4 million Americans eligible for Medicare. Individual MA policies acquired through direct purchase policies stood at 20.4 million members as of October 1, 2020. However, while individual policies command the MA market, employer-group retiree programs, also known as Medicare Advantage Employer Group Waiver Plans (MA-EGWP), continue to experience steady enrollment increases. Employer-group Medicare Advantage enrollment has grown to nearly 4.7 million members, an increase of almost 209,000, or 4.7%, since December 2019. Furthermore, group market enrollment has grown by approximately 977,000 members since December 2017. Group MA currently encompasses 18.4% of total MA market. In this brief, Mark Farrah Associates (MFA) compares the latest aggregated employer group Medicare Advantage enrollment reports with recent year-end enrollment reports from the Centers for Medicare and Medicaid Services (CMS).

Enrollment Trends by Carrier and State

Competition persists within the group Medicare Advantage market segment. As of October 2020, UnitedHealth has maintained its position at the top of the segment with over 1.3 million members. However, the company’s group enrollment declined 4.3% since December 2019. CVS/Aetna grew to over a million enrollees, gaining over 14% YTD in 2020. Humana and BCBS of Michigan have posted the largest gains in 2020 with each growing approximately 17%. Kaiser experienced below average YTD growth of 1.2%, allowing Humana to take control of 3rd spot amongst the segment leaders.

| Top 5 Medicare Advantage Payers - Group Segment Membership Trend |

||||

|---|---|---|---|---|

| Company | Dec-17 | Dec-18 | Dec-19 | Oct-20 |

| UnitedHealth | 1,148,615 | 1,295,804 | 1,388,312 | 1,328,320 |

| CVS/Aetna | 547,618 | 694,752 | 913,661 | 1,043,848 |

| Humana | 428,240 | 484,402 | 511,964 | 598,757 |

| Kaiser | 525,711 | 538,304 | 552,150 | 558,793 |

| BCBS of Michigan | 318,675 | 371,745 | 378,427 | 441,058 |

| Total | 2,968,859 | 3,385,007 | 3,744,514 | 3,970,776 |

Source: Medicare Business OnlineTM, Mark Farrah Associates, presenting data from CMS enrollment reports

All 5 of the leading group MA health plans achieved sizeable growth in membership over the past 3 years. UnitedHealth added nearly 180,000 enrollees since December 2017, an increase of 15%. CVS/Aetna experienced the second largest growth rate of 90% since December 2017, with a gain of 496,000 members. Overall, the top five companies gained just over 1 million beneficiaries equating to a 34% enrollment increase since 2017. While not in the top 5, Anthem’s MA presence has grown in many states, most notably in California, Colorado and Connecticut and experienced triple digit growth since December 2017, to 176,000 members, or 808%.

Between December 2017 and October 2020, the United States and territories experienced a 26% overall growth rate in group MA market enrollment. All the leading ten states by enrollment experienced membership increases with California topping the list at nearly 646,000 members. New Jersey experienced the largest increase of 77% since December 2017, in part due to CVS/Aetna gains within the state.

| Top 10 States Medicare Advantage - Group Segment Membership Trend |

||||

|---|---|---|---|---|

| State | Dec-17 | Dec-18 | Dec-19 | Oct-20 |

| CA | 552,221 | 588,811 | 624,279 | 645,847 |

| MI | 333,653 | 392,191 | 404,719 | 460,609 |

| TX | 244,097 | 315,669 | 324,287 | 333,383 |

| NY | 250,598 | 263,598 | 270,706 | 280,206 |

| OH | 204,936 | 235,889 | 237,570 | 246,419 |

| PA | 216,773 | 218,481 | 223,159 | 226,085 |

| IL | 189,044 | 198,894 | 203,552 | 210,576 |

| NJ | 117,771 | 122,375 | 200,281 | 208,337 |

| NC | 154,050 | 178,491 | 190,236 | 194,159 |

| FL | 139,670 | 163,111 | 179,954 | 190,594 |

| Subtotal | 2,402,813 | 2,677,510 | 2,858,743 | 2,996,215 |

| All Other States | 1,298,878 | 1,468,865 | 1,611,517 | 1,682,898 |

| Total | 3,701,691 | 4,146,375 | 4,470,260 | 4,679,113 |

Source: Medicare Business OnlineTM, Mark Farrah Associates, presenting data from CMS enrollment reports

About this Data

This brief is based on an analysis of employer-group enrollment data for Medicare Advantage released by the Centers for Medicare & Medicaid Services (CMS). Mark Farrah Associates’ Medicare Business Online™ simplifies the tracking of monthly Medicare Advantage and PDP enrollment by competitor. Enrollment data is updated monthly as soon as CMS releases new data.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health Plus™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.