Third Quarter 2019 Profit Margins for Leading Blue Cross Blue Shield Plans

January 21, 2020

Blue Cross Blue Shield plans have been health insurance leaders for decades and the Blues brand continues to generate broad-based market appeal. BCBS companies have a significant presence in every state and U.S. territory and typically have diversified product portfolios with commercial, Medicare and Medicaid business along with specialty benefits. According to MFA’s Health Coverage Portal™, as of September 30, 2019, BCBS membership comprised 48% of total U.S. commercial enrollment, or nearly 94 million members. Blue Cross Blue Shield plans with over $10 billion in revenue at third quarter 2019 include Anthem, Health Care Service Corp. (HCSC), Blue Shield of CA, BCBS of Michigan Group, Guidewell Mutual Holding Group, Independence Blue Cross (IBX), and Highmark.

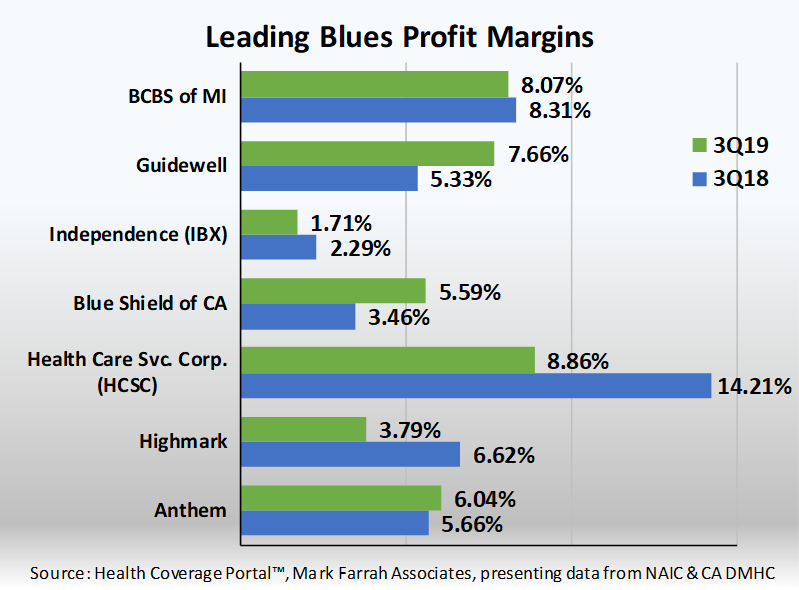

For these top seven BCBS affiliated insurers, three companies, Anthem, Blue Shield of CA and Guidewell, reported improved profit margins for 3Q19. The overall profitability for the remaining industry leaders has shown a year-over-year decrease based upon available statutory reporting as of September 30, 2019. In this edition of Healthcare Business Strategy, Mark Farrah Associates assesses profit margins of the top Blue Cross and Blue Shield plans, comparing year over year performance as of September 2019, based on National Association of Insurance Commissioners (NAIC) and the California Department of Managed Health Care (CA DMHC) statutory reporting.

- BCBS of Michigan’s profit margin decreased nearly 3% from 8.31% in 3Q18 to 8.07% in 3Q19.

- Guidewell reported a 43.8% increase with a profit margin of 7.66%, up from 5.33% a year ago due in part to reduced administrative costs per member.

- Independence Blue Cross (IBX) experienced a decline in profit margin from 2.29% in 3Q18 to 1.71% in 3Q19, primarily due to increased medical expenses, which outpaced the growth revenue.

- Blue Shield of CA increased its profit margin to 5.59% from 3.46% due in part to increased revenue per member.

- Health Care Service Corp (HCSC) reported the largest profit margin of top Blues plans of 8.86% in September 2019, however, this was a sizable decrease from 14.21% at September 2018. This is due to decreased premium revenue pmpm and increased medical expenses pmpm.

- Highmark’s profit margin of 3.79% in 3Q19 fell from 6.62% in 3Q18 due in part to growth in medical expenses outpacing that of revenue.

- Anthem’s 3Q19 profit margin of 6.04% improved from 5.66% a year ago due in part to lower administrative spending.

After a profitable year overall in 2018, so far in 2019 we see some continued growth, although results are mixed with some leaders reporting lower profitability. Full annual results will not be available until spring. With more than 80 years of experience, Blues plans will continue to lead as major contributors working to transform the healthcare industry. As always, Mark Farrah Associates will report on important BCBS plan performance and provide valuable health insurance insights in its future briefs.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.