Improved Profit Margins for Leading Blue Cross & Blue Shield Plans in Third Quarter 2017

January 30, 2018

Recent revisions to the Affordable Care Act (ACA) and the unforeseen future of health care law have insurers modifying business strategies to achieve stability within the uncertain terrain of the health care landscape. Health plans are consistently evaluating performance measures and assessing competition amongst their industry peers. Over the past few years, many insurers have increased premiums and implemented programs aimed at controlling costs to help improve profitability. Blue Cross and Blue Shield plans are no exception to this planning as carriers plod through ACA requirements and changes. In this edition of Healthcare Business Strategy, Mark Farrah Associates analyzes profit margins of the top Blue Cross and Blue Shield (BCBS) plans, comparing year over year performance as of September 2017, based on data from the National Association of Insurance Commissioners (NAIC) and the California Department of Managed Health Care (CA DMHC) statutory reporting.

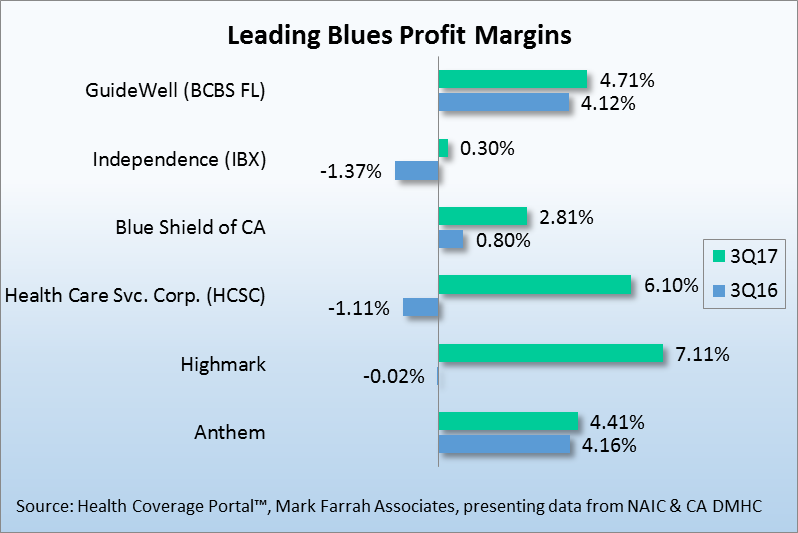

The leading BCBS affiliated insurers include GuideWell (BCBS FL), Blue Shield of CA, Anthem, Highmark, Independence Blue Cross (IBX), Health Care Service Corp. (HCSC). These industry leaders reported improved profitability based on available statutory reporting as of September 30, 2017.

- GuideWell’s (BCBS FL) profit margin grew to 4.71% from 4.12% in September of 2016 due in part to lower administrative expenses as a percentage of revenue.

- Independence Blue Cross reported a profit margin of .30%, as of September 30, 2017, up from a negative 1.37% in September of 2016 due in part to increased premium revenue per member and reduced spending on administrative costs.

- Blue Shield of CA increased its profit margin to 2.81% from 0.80% due in part to lower administrative expenses as a percentage of revenue.

- Health Care Service Corp’s (HCSC) experienced the largest margin improvement, increasing to 6.10% in 3Q17 from -1.11% in 3Q16 mostly due to revenue, which outpaced the grown of medical costs, along with decreased spending on administrative costs.

- Highmark’s leading profit margin of 7.11% jumped from -0.02% in 3Q16 mostly due to lower medical and administrative costs as a percentage of revenue.

- Anthem’s 3Q17 profit margin of 4.41% improved from 4.16% a year ago due in part to lower administrative expenses as a percentage of revenue.

Although this analysis shows improved profitability for leading BCBS affiliated insurers in third quarter 2017, it's a wait and see proposition until final annual financial results are revealed this spring. Blue Cross and Blue Shield plans continue to be health insurance leaders. The Blues brand has generated broad-based market appeal for decades as its influence on the healthcare industry is a testament to the success of its business model. While the political debate surrounding health care law has certainly caused concern, many insurers continue to move forward and adapt to the changing healthcare environment. Mark Farrah Associates will continue to analyze and report on important health insurance performance and related topics. Stay tuned for future analysis briefs with valuable insights about the health care industry.

About Mark Farrah Associates (MFA)

The data used in this analysis brief was obtained from Mark Farrah Associates' Health Coverage Portal TM. MFA maintains detailed financial data as well as enrollment and market share for the health insurance industry in the subscription-based Health Coverage Portal TM.

For more information about our products, refer to the product videos and brochures available on Mark Farrah Associates website or call 724-338-4100.

Healthcare Business Strategy is a free monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section in the grey area at the bottom of the page.

Request Information

within 1-2 business days.