Blue Cross Blue Shield (BCBS) vs. Non-BCBS: Health Enrollment Trends

April 16, 2020

When evaluating the performance of health insurance companies, that in total provided coverage for over 267 million people nationwide, it is interesting to compare enrollment growth trends between Blue Cross Blue Shield (BCBS) and non-BCBS plans on an aggregate basis.

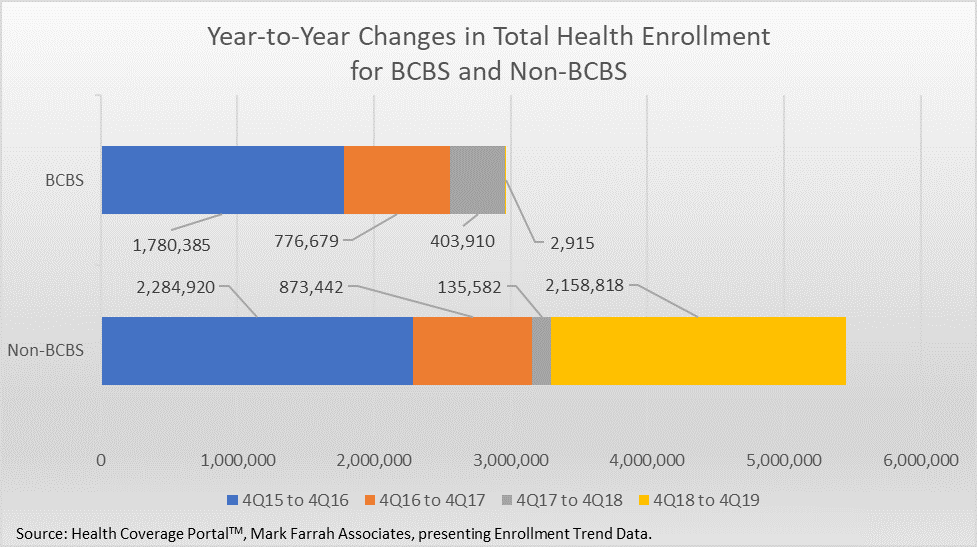

In terms of total health enrollment, both BCBS and non-BCBS companies experienced substantial increases in 2016, followed by decreasing gains in 2017 and 2018. In 2019, while BCBS enrollment grew by only 2,915 enrollees, non-BCBS enrollment surged by 2.1 million, which can be attributed in part to the increase in Medicare enrollees over that year. From a five-year outlook, BCBS companies experienced a 2.81% growth in total enrollment, while non-BCBS enrollment increased by 3.54%.

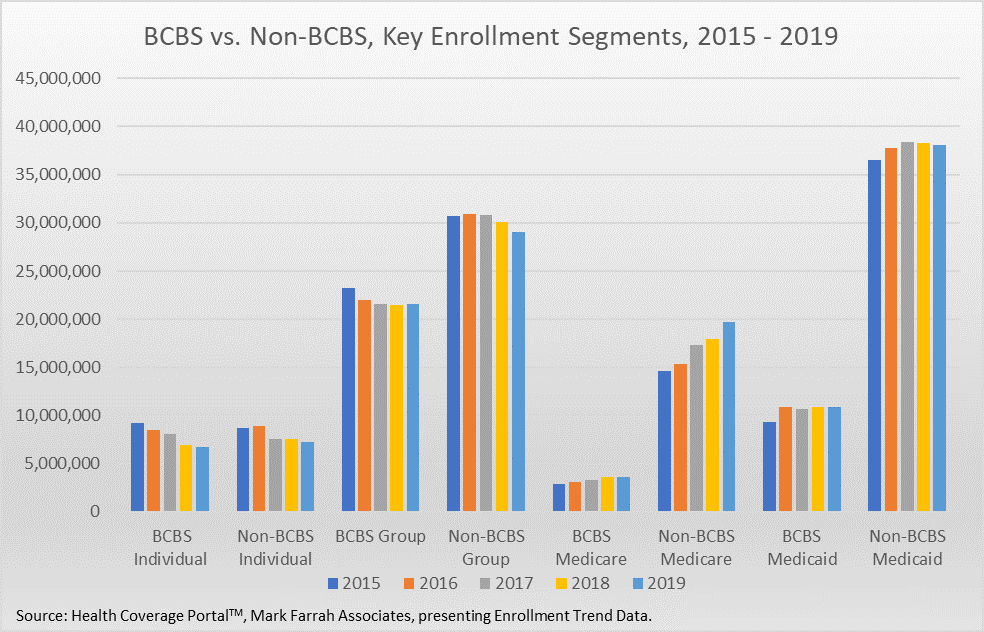

Both BCBS and non-BCBS plans experienced significant decreases for Individual and Group enrollment throughout the 5-year period, while trending upwards for Medicare and Medicaid.

BCBS companies experienced a 27.03% total decrease in Individual enrollment, as well as a drop of 6.99% for Group enrollment. Non-BCBS companies had a 16.82% drop in Individual enrollment, while only losing 5.28% in Group enrollment.

Medicare and Medicaid enrollment for both BCBS and non-BCBS companies increased from 2015 to 2019. In terms of total change, Medicare enrollment increased by approximately 687,000 for BCBS companies, representing a 23.37% increase, while non-BCBS enrollment increased by over 5.1 million, constituting a 35.21% increase. Medicaid enrollment for both BCBS and non-BCBS companies increased by similar amounts over the five-year period (approximately 1.5 million each). However, this was a larger percentage increase for BCBS enrollment, representing a growth of 16.66% compared to 4.12% for non-BCBS.

About the Data

The data used in this analysis brief was obtained from Mark Farrah Associates' Health Coverage Portal™ database. In some cases, estimates were made to account for late filing health insurance plans in order to better represent market segment size. Findings reflect enrollment reported by carriers with business in the U.S. and U.S. territories. Data sources include NAIC (National Association of Insurance Commissioners) and the CA DMHC (California Department of Managed Health Care).

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.