A Brief Analysis of the Medicare Market in Six Major Metro Areas

December 13, 2021

Total current Medicare Advantage (MA) membership is 28.0 million, representing 44% of the 63.6 million Americans eligible for Medicare. Within Metropolitan Statistical Areas (MSAs), where 83% of Medicare Eligible people reside, Medicare Advantage penetration can be significantly higher. As the number of Medicare beneficiaries increases, health plans are looking for new and under penetrated markets in which to expand. Companies also evaluate their own market positions against competitors to assess ongoing relative market opportunity. Market share at the county or MSA level is often analyzed to gain a more nuanced competitive picture of specific markets. This brief presents an overview of Medicare market demographics and market share data, with a focus on health plan market positions for six major MSAs in the U.S.

Competition and Market Share

Mark Farrah Associates (MFA) analyzed Medicare and Medicare Advantage (MA) market enrollment figures included in the Health Coverage Portal™ and Medicare Business Online™ by major metropolitan statistical areas (MSAs) in the United States. Data for total Medicare Eligibles, those enrolled in Original Medicare (without Part C), and those enrolled in Medicare Advantage (Part C) are presented in the following table for the major MSAs with over a million seniors currently eligible for Medicare. These six areas represent the largest metropolitan markets in the country for companies offering MA plans.

|

Metropolitan Area |

Medicare Eligibles as of 11/1/2021 |

Original Medicare Enrollment as of 6/30/2021 |

Original Medicare Penetration |

Medicare Advantage Enrollment as of 11/1/2021 |

Medicare Advantage Penetration |

New York - Newark- Jersey City |

3,393,467 |

2,039,390 |

60.1% |

1,349,275 |

39.8% |

Los Angeles - Long Beach - Anaheim |

2,081,982 |

957,202 |

46.0% |

1,114,838 |

53.5% |

Chicago- Naperville - Elgin |

1,585,012 |

1,037,061 |

65.4% |

546,518 |

34.5% |

Philadelphia - Camden - Wilmington |

1,174,560 |

737,249 |

62.8% |

431,452 |

36.7% |

Miami - Fort Lauderdale - West Palm Beach |

1,161,029 |

448,821 |

38.7% |

715,329 |

61.6% |

Dallas - Fort Worth - Arlington |

1,019,546 |

548,174 |

53.8% |

466,813 |

45.8% |

Subtotal - Top 5 MSA |

10,415,596 |

5,767,897 |

55.4% |

4,624,225 |

44.4% |

All Other MSA |

42,242,788 |

22,658,943 |

53.6% |

19,462,120 |

46.1% |

Total - MSA |

52,658,384 |

28,426,840 |

54.0% |

24,086,345 |

45.7% |

All Other - Non MSA |

10,943,131 |

6,972,964 |

63.7% |

3,914,156 |

35.8% |

Total |

63,601,515 |

35,399,804 |

55.7% |

28,000,501 |

44.0% |

Source: Medicare Business Online™, Mark Farrah Associates, presenting data from CMS enrollment reports |

|||||

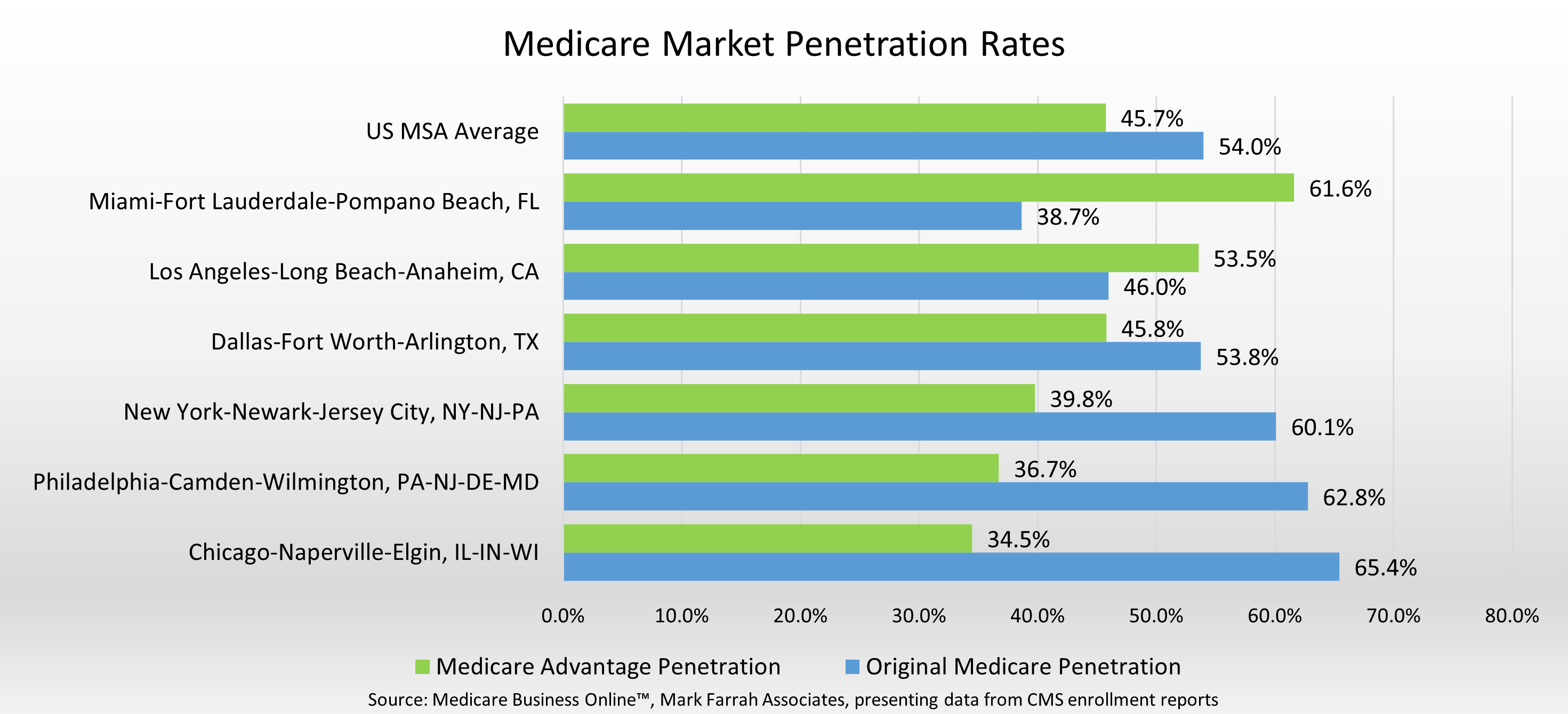

In addition to market size represented above, market share can be used to analyze insurance preferences between original Medicare and MA plans. Senior plan choices vary due to a wide array of reasons and concerns. However, senior behavior can be analyzed utilizing penetration rates at a regional level. MFA calculated the penetration rate for original Medicare and MA plans by dividing enrollees by the number of those eligible for Medicare.

As shown below, original Medicare and MA penetration rates vary across the top six MSAs. Miami had the highest penetration rate of the top six MSAs in the MA market at 61.6% and the lowest original Medicare penetration rate at 38.7%. Los Angeles also had an above average MA rate at 53.5%. The Chicago MSA had the highest original Medicare rate among the top six MSAs, at 65.4%, and the lowest MA penetration rate of 34.5%. The lower MA penetration in Chicago was partly due to the popularity of Individual Medicare Supplement plans in Illinois.

The below table indicates the top MA companies and their corresponding market share in each of the top MSAs, based upon MFA’s Medicare Business Online™ . UnitedHealth Group continued to have a strong presence in five of the six largest MSAs. In the Philadelphia MSA, UnitedHealth Group ranked fourth, behind Cigna. Humana also had a significant presence in the selected MSAs and was the leading carrier in the Miami and Chicago markets, as of November 1, 2021.

|

Top Medicare Advantage Companies |

Medicare Advantage Enrollment as of 11/1/2021 |

Medicare Advantage Market Share as of 11/1/2021 |

New York - Newark - Jersey City |

||

UNITEDHEALTH GRP |

364,046 |

27.0% |

CVS GRP |

263,366 |

19.5% |

Los Angeles - Long Beach - Anaheim |

||

KAISER FOUNDATION |

370,069 |

33.2% |

UNITEDHEALTH GRP |

144,366 |

12.9% |

Chicago - Naperville - Elgin |

||

HUMANA GRP |

163,653 |

29.9% |

UNITEDHEATLH GRP |

151,098 |

27.6% |

Philadelphia - Camden - Wilmington |

||

CVS GRP |

124,331 |

28.8% |

INDEPENDENCE BLUE CROSS GRP |

112,004 |

26.0% |

Miami - Fort Lauderdale - West Palm Beach |

||

HUMANA GRP |

249,472 |

34.9% |

UNITEDHEALTH GRP |

156,223 |

21.8% |

Dallas - Fort Worth - Arlington |

||

UNITEDHEATLH GRP |

276,534 |

59.2% |

HUMANA GRP |

75,496 |

16.2% |

| Source: Medicare Business Online™, Mark Farrah Associates, presenting data from CMS enrollment reports | ||

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health PLUS, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures, available under the Our Products section of the website (www.markfarrah.com) or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page. Mark Farrah Associates will continue to analyze and report on important health insurance segment performance and related topics. Stay tuned for future analysis briefs with valuable insights about the health care industry.

Request Information

within 1-2 business days.