A Brief Analysis of Private Sector Health Insurance Business in the New York City Metropolitan Area

July 21, 2021

The U.S. Department of Labor’s Form 5500 Series data offers a wealth of information about employers’ health and welfare benefits offered to their employees, as well as the relationships with health insurers and brokers. Savvy industry analysts can use the 5500 data to support the sales and marketing efforts of health insurers and brokers by gaining an understanding of their competition’s current relationships with employers. This brief presents an analysis of the top insurers and employers in the New York City metropolitan statistical area (MSA). Health benefit insights were gleaned from Mark Farrah Associates’ (MFA’s) 5500 Employer Health Plus , a product designed to simplify the analysis of the 5500 series data.

Top Insurers and Total Premiums

Benefit information found within the 5500 Series filings includes insurer-reported figures such as insured counts, premiums, as well as some employer/sponsor and broker information. Form 5500 data can be utilized through an examination of insurance competitors at the city level. New York City is one such MSA and home to several large insurers competing for a share of the ever-growing health insurance market.

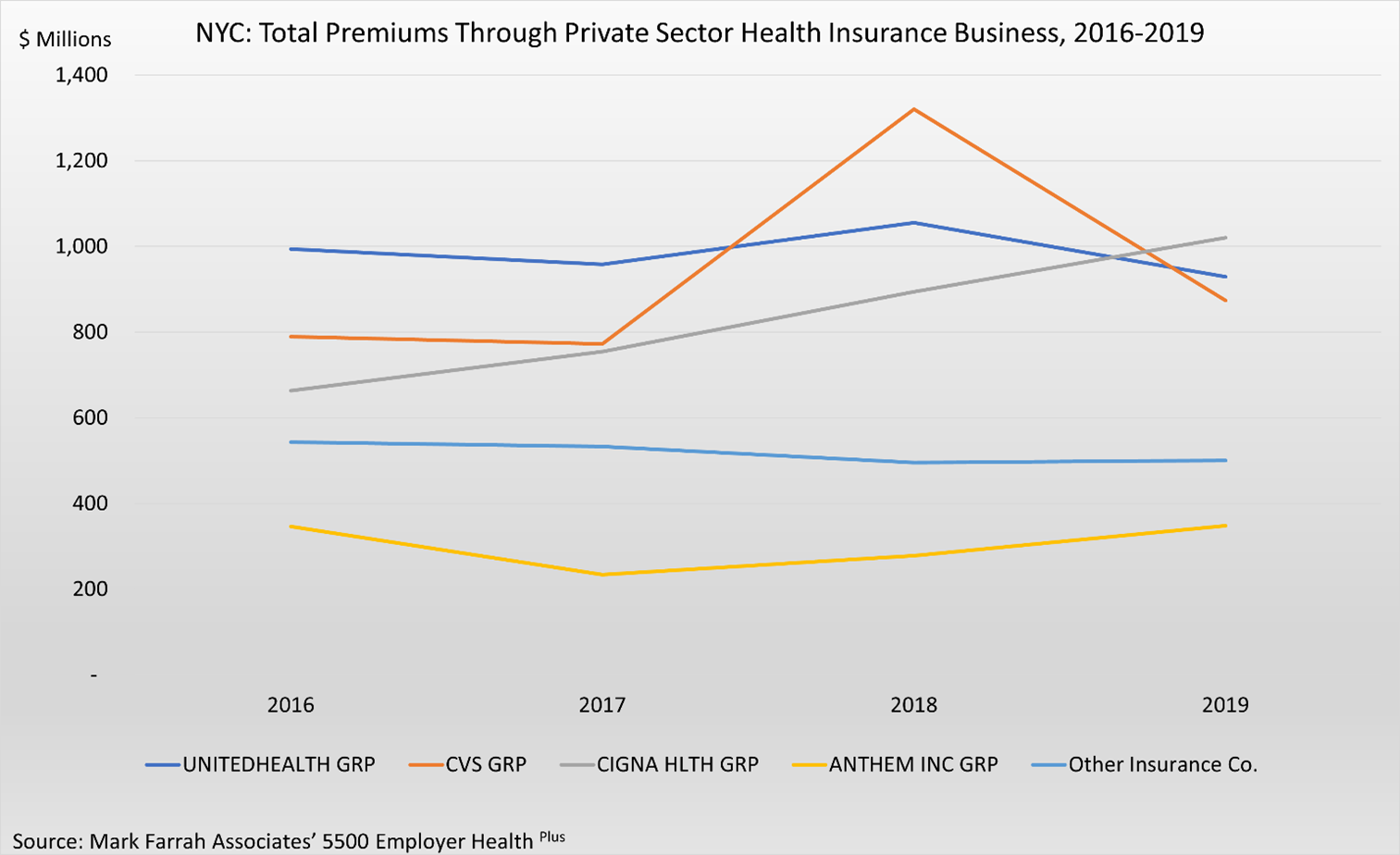

While 5500 data does not represent the full market, it still offers key insights into the insurance benefits offered by private employers. Focusing on total premiums earned through risk-based insurance (not self-funded), UnitedHealth was the leader of the pack at the beginning of the observed period in 2016, accounting for a substantial 29.8% ($994 million) of all reported premiums. The insurer held that top position through 2017. In the same time frame, CVS held a steady 23.7% in the first two years but surged to 32.6% in 2018, representing over $1.3 billion in total premiums, as shown in the graph below [1].

While UnitedHealth and CVS showed year-to-year variances in total premiums through the period, Cigna experienced steady, significant growth and was the only insurer to continuously grow in total premiums across the period. Reported premiums for the insurer grew by $357.1 million between 2016 and 2019. The company’s share of total premiums grew to 27.8% by the end of 2019.

Following an initial drop of over $112 million in total premiums in 2017, Anthem maintained relatively steady growth in the following years, gaining $43.7 million in 2018 and $69.9 million in 2019. As a share of total premiums, Anthem began at 10.4% and fell to 7.2% in 2017, but was able to grow up to 9.5% in 2019. The remainder of the insurers, represented by the line denoted as “Other Insurance Co.” on the above graph, experienced little variance overall compared to the top insurers, but did decrease over time as the larger companies expanded.

Top Employers in 2019

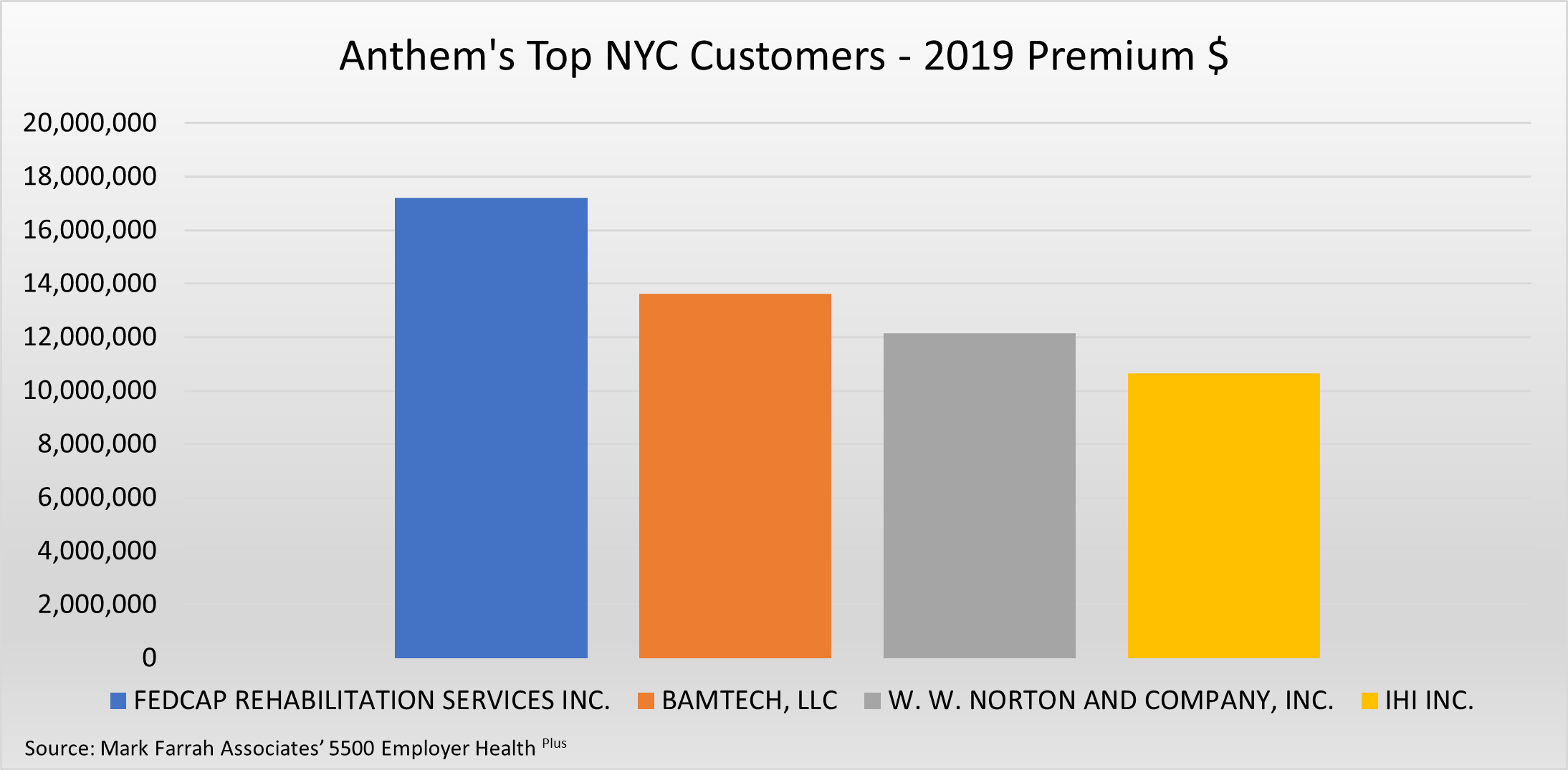

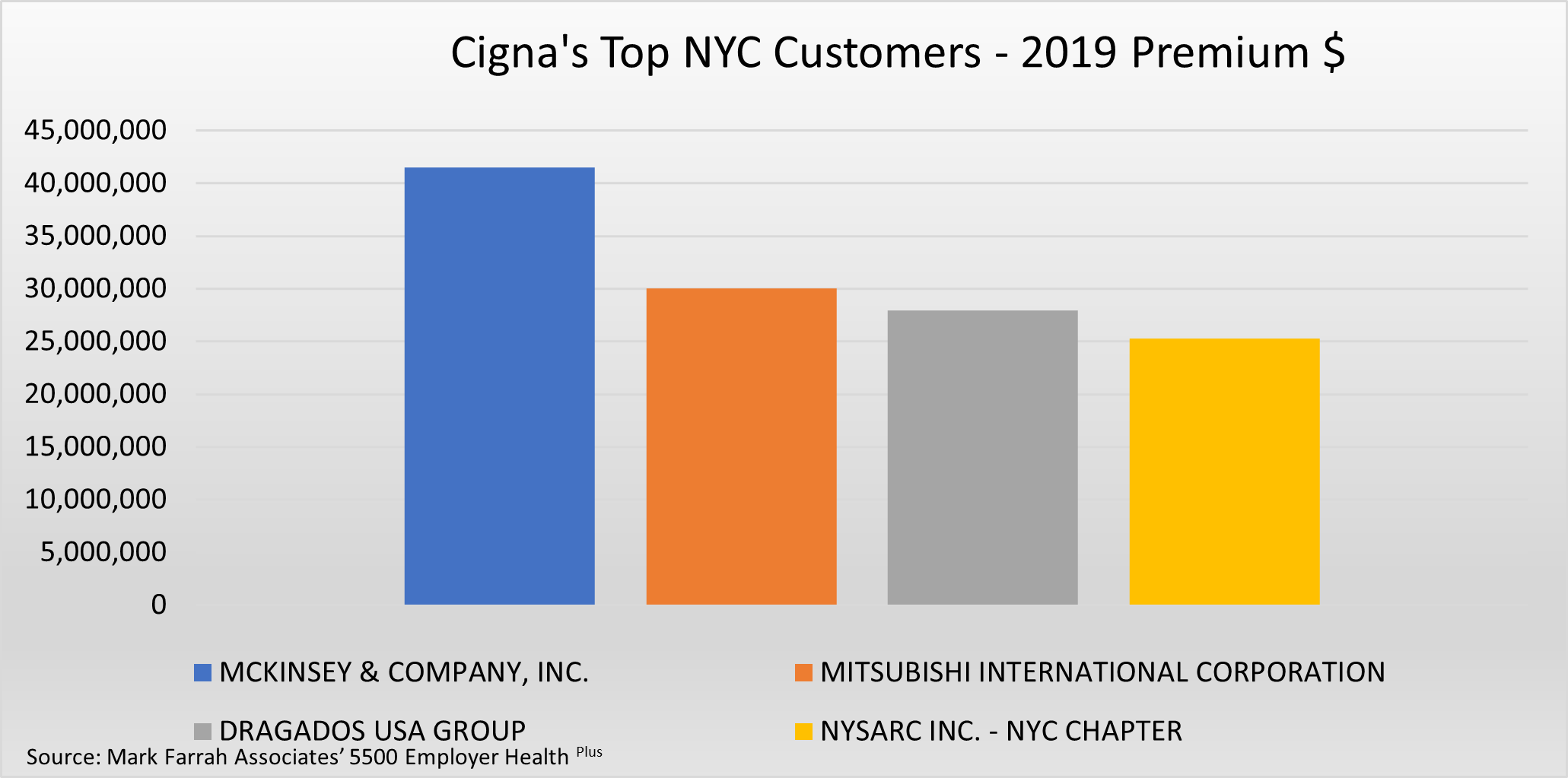

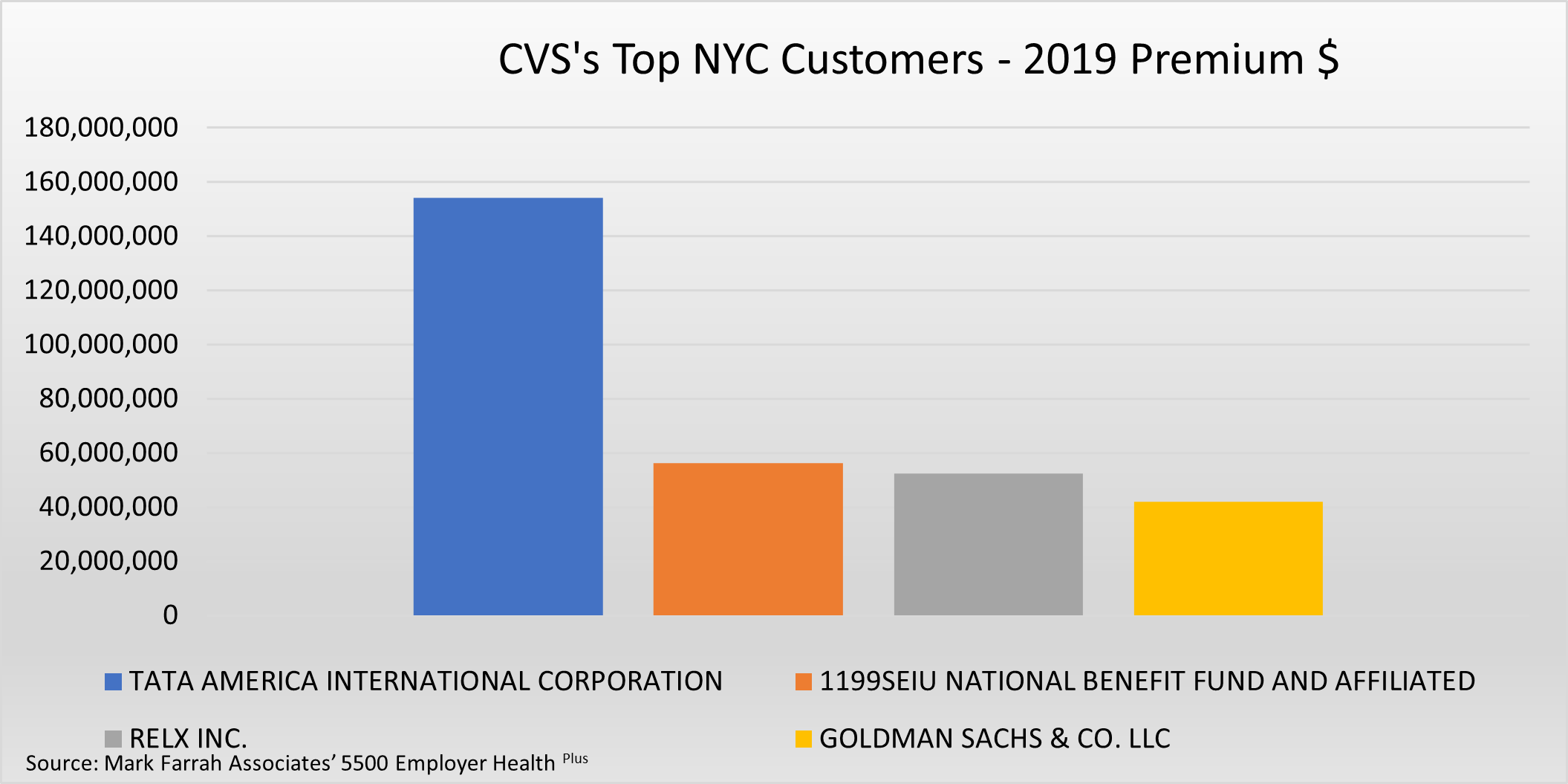

In addition to the top insurers and premiums discussed above, 5500 reporting also focuses on specific employers and their contributions to an insurer’s performance. As illustrated in the charts below, 5500 data can be used to examine the top employers (referred to as customers in this context) for any given year. The top insurers, Anthem, Cigna, CVS, and UnitedHealth, and their respective top customers, paint a unique picture for private sector health insurance.

Anthem

- Fedcap & WW Norton have been Anthem's top NYC customers for many years.

- Bamtech first reported with Anthem in 2018.

- IHI Inc. has used Anthem for health insurance since 2018. Prior to Anthem, the company used Nippon Life.

Cigna

- McKinsey, Mitsubishi, and Dragados have been Cigna customers for many years.

- NYSARC reported insurance relationships with UnitedHealth and Emblem in recent years; however, the company moved to Cigna for 2019.

CVS

- Tata America International Corporation was the largest customer from 2016 to 2019 and remained consistently larger than its next top three competitors combined, every year.

- 1199SEIU National Benefit Fund was a new customer for CVS in 2019.

- Relx Inc. has business with all top insurers except Anthem, at least from 2016 to 2019.

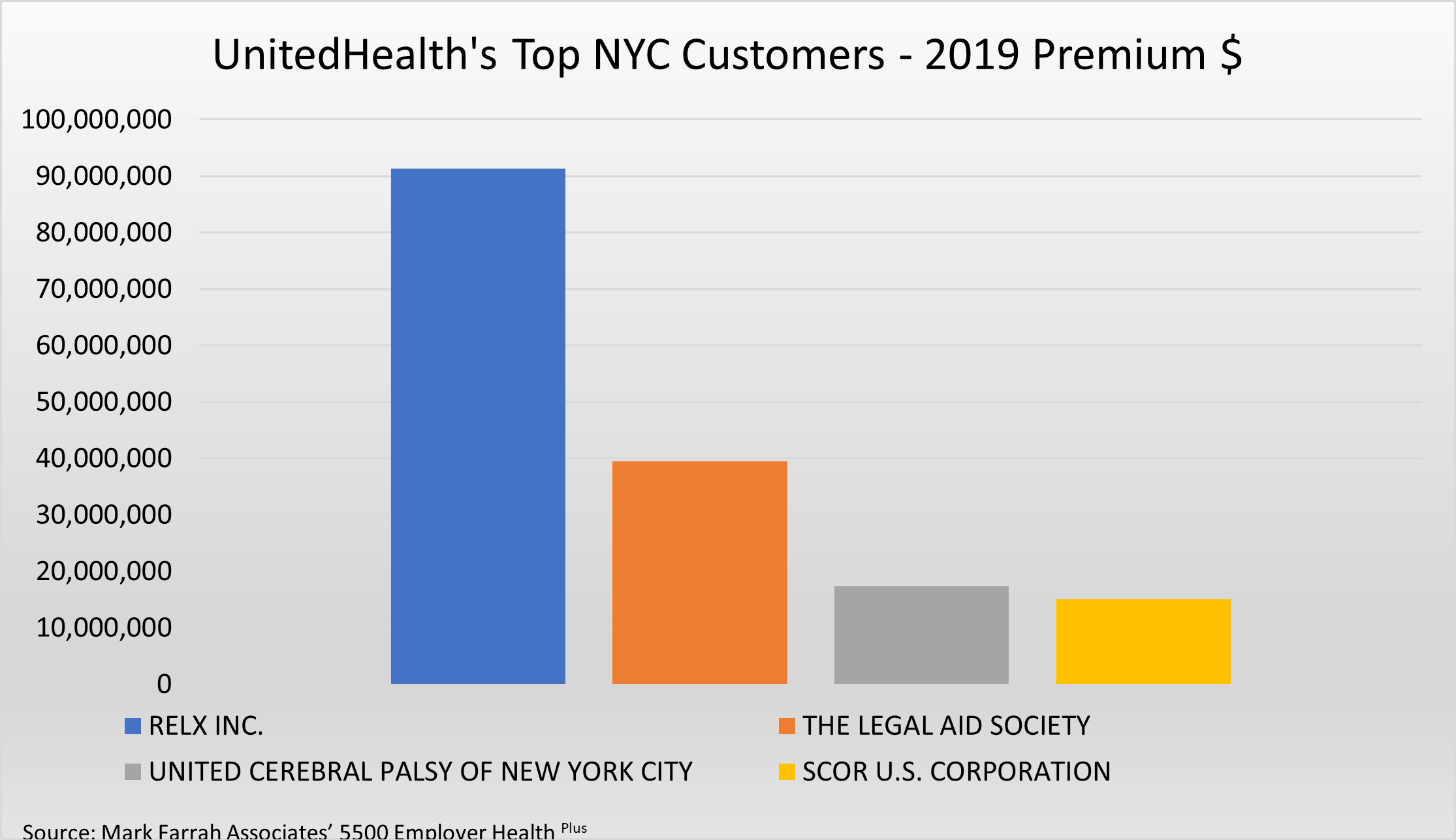

UnitedHealth

- Legal Aid Society was the largest customer prior to being overtaken by Relx Inc. in 2018, maintaining a consistent second place position going forward into 2019.

- Relx Inc. deals with Cigna, CVS, and UnitedHealth, but is overwhelmingly the largest customer for UnitedHealth in 2019.

Form 5500 reporting can shed light on the competitive insurance marketplace for any given city. With proper examination, this data can be expanded to any state or region, providing more depth and opportunities to explore the impact private sector health insurance business can have on the industry. Mark Farrah Associates will continue to analyze and report on important health insurance related topics.

About 5500 Employer Health Plus

The data used in this analysis brief was obtained from Mark Farrah Associates' 5500 Employer Health Plus. This new tool has been designed to simplify the analysis of employer health & welfare benefits including medical, dental, vision, disability, and other benefits. MFA’s 5500 Employer Health Plus uniquely focuses on health & ancillary benefits purchased by private sector employers and the relationships employers have with contracted insurers, administrators, and brokers. The user interface allows for both detailed and summary level data retrieval. Data sources includes Form 5500 filings and related schedules for plans that have the indication of providing health & welfare benefits.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, 5500 Employer Health Plus, Medicare Business Online™, Medicare Benefits Analyzer™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section at the bottom of this page.

[1] This increase is attributed primarily to Justworks Employment Group, reporting approximately $423.5 million in premiums in 2018. As of the date of this publication, Justworks had not yet filed for 2019, so it is unclear if their trend in premium reporting will continue into future years.

Request Information

within 1-2 business days.