Medicare Market Competition for 2021

October 21, 2020

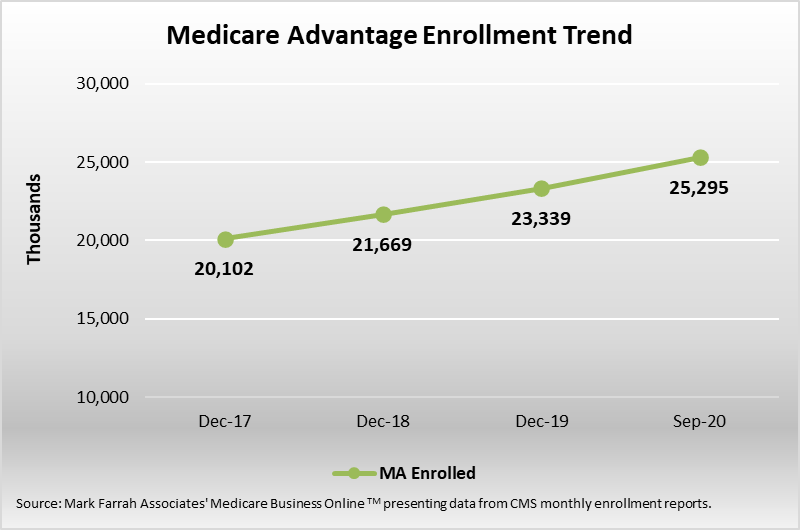

With extra benefits and services at lower costs over original Medicare, Medicare Advantage continues to remain an appealing option for seniors. Medicare Advantage (MA) market penetration is strong, however, there is still ample opportunity for growth in this segment with approximately 40% of the nearly 63 million people eligible for Medicare enrolled in MA plans1. MA commands a sizable share of the healthcare industry, providing medical coverage to over 25 million beneficiaries. In the last three years, these plans have collectively increased enrollment by approximately 5.2 million members. The 2021 Annual Election Period (AEP) for Medicare Advantage (MA) plans and prescription drug plans (PDPs) is underway as of October 15th. Medicare Benefits Analyzer™, a Mark Farrah Associates’ database, helps simplify analysis of the Medicare.gov data for companies competing in this segment. This brief presents a snapshot of the 2021 Medicare Advantage market with insights from the Centers for Medicare and Medicaid Services (CMS) Medicare Landscape reports.

Medicare Landscape at a Glance

Based on an aggregate analysis of CMS Landscape reports, a total of 4,958 distinct Medicare Advantage (MA) plan offerings are in the market lineup for the 2021 AEP. This includes MA plans, Medicare Advantage with prescription drug plans (MAPDs), Medicare/Medicaid plans (MMPs), and Special Needs Plans (SNPs). During the AEP, Medicare beneficiaries can choose to change MA plans or switch from Original Medicare to MA, for plan benefits effective on January 1, 2021. A total of 3,939 MA and MAPD plans are being offered for 2021, a considerable increase from 3,534 in 2020. Health Maintenance Organizations (HMOs) continue to be the dominant MA plan type with 2,440 offerings, or 61% of all MA plans for the coming year. Additionally, 1,019 Special Needs Plans (SNPs) are available in 2021, up from 873 in 2020. Stand-alone PDPs, nationwide, increased from 959 plans in 2020 to 1,007 plan offerings for 2021.

Medicare Advantage Plan Counts (MA & MAPD) |

||||||||

|---|---|---|---|---|---|---|---|---|

|

Year |

Cost |

Local HMO |

Local PPO |

MMP |

MSA |

PFFS |

Regional PPO |

Total |

|

2020 |

80 |

2,252 |

1,055 |

44 |

6 |

45 |

52 |

3,534 |

|

2021 |

70 |

2,440 |

1,292 |

43 |

5 |

37 |

52 |

3,939 |

|

Special Needs Plan Counts (SNPs) |

||||

|

Year |

Local HMO |

Local PPO |

Regional PPO |

Total |

|

2020 |

784 |

77 |

12 |

873 |

|

2021 |

910 |

97 |

12 |

1,019 |

Stand-alone Prescription Drug Plan Counts (PDPs) |

|

|

Year |

PDP |

|

2020 |

959 |

|

2021 |

1,007 |

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare Landscape Source Files;

excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

A total of 3,533, or 90% of MA plans, include Part D benefits. Total monthly premiums range from $0 to $351. Fifty-four percent of 2021 MA plans (excluding SNPs) are available at the $0 plan premium level. In addition, 24% of all plans will be charging monthly premiums ranging from $2 to $50, while 12% of plan premiums are in the $51 to $100 range. Only 59 plans (1%) are charging monthly premiums greater than $200. These benefits-rich plans typically have low copays and as a result estimated out-of-pocket expenses are often minimal.

2021 Medicare Advantage Part D Coverage |

||

|

Count |

Percent |

|

|

Total Number of Plans |

3,939 |

100% |

|

Plans without Part D |

406 |

10% |

|

Plans with Part D |

3,533 |

90% |

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare Landscape Source Files;

excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

2021 Medicare Advantage Premium Spread |

||

|

Count |

Percent |

|

|

Total Number of Plans |

3,939 |

100% |

|

$0 Premium |

2,145 |

54% |

|

$2 - $50 Premium |

963 |

24% |

|

$51 - $100 Premium |

485 |

12% |

|

$101 - $200 Premium |

282 |

7% |

|

Greater than $200 Premium |

59 |

1% |

|

Null Premium Value |

5 |

0% |

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare Landscape Source Files;

excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

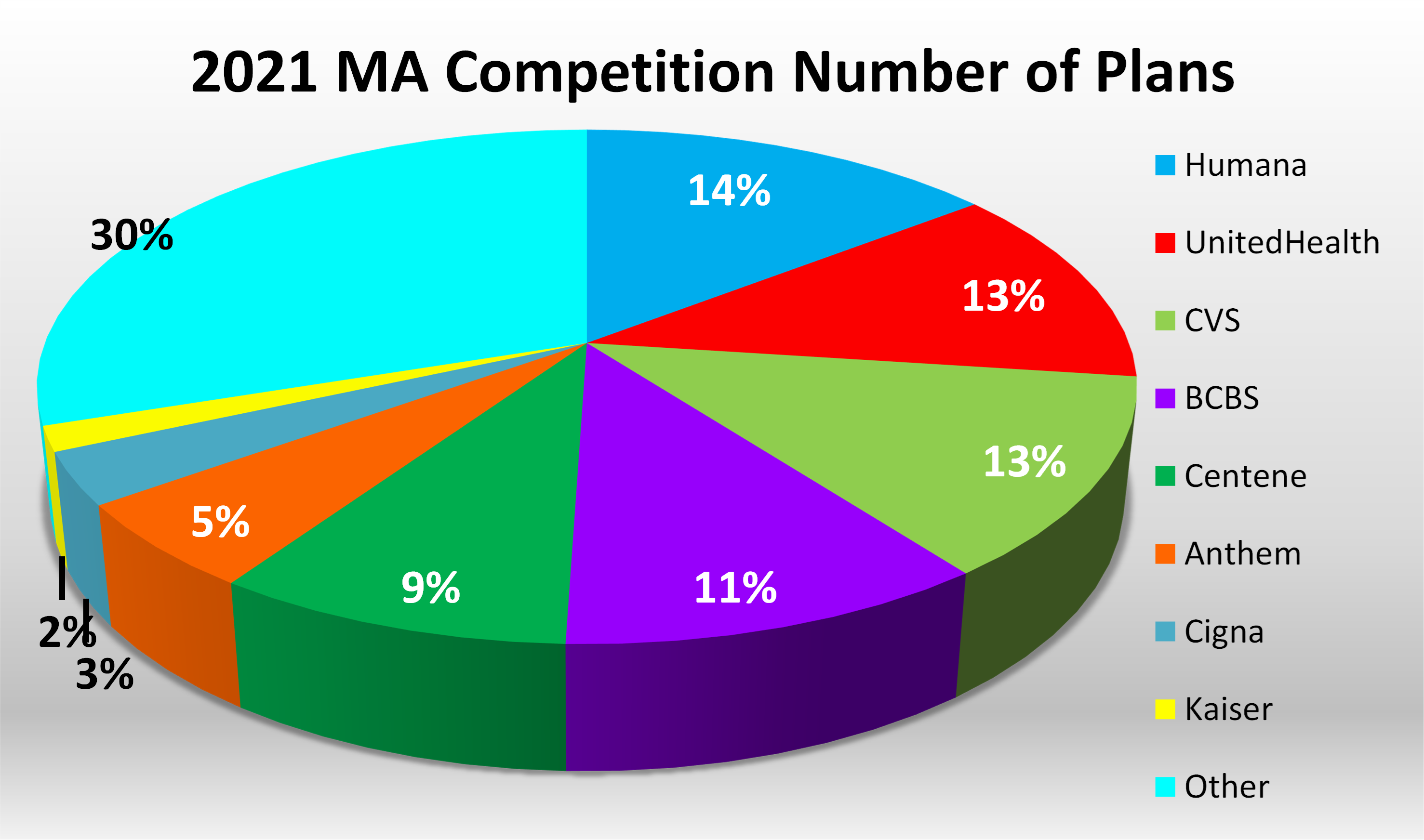

2021 Plan Competition

Many MA plans and stand-alone PDPs will continue to broaden their current supplemental offerings and coverage area for 2021. According to the 2021 CMS Landscape reports, Humana will market more MA plans than any other insurer nationwide, with 571 distinct plans. The insurer announced it is planning to expand its Medicare Advantage HMO plans into 125 new counties and that it would launch PPO plans in 98 new counties, expecting to serve approximately 3 million more MA beneficiaries in 2021. UnitedHealth and CVS also continued to increase MA plan offerings for the 2021 calendar year, identifying 496 distinct plans, each. Anthem announced it will be focusing on the social determinants of health by offering 217 plans and increasing the number of counties by 20%. The company will also enter the Iowa market for the first time. Furthermore, BCBS companies and Centene have notable plan offerings, with 427 and 355, respectively.

Medicare Benefits AnalyzerTM for Comparing Medicare Benefits

Analysts often use benefits data from the Medicare.gov website to compare plan premiums, copays and star rating awards, market by market. Identifying plan-by-plan benefits details such as annual Out-of-Pocket Limits and Deductibles; Primary Care Doctor Visit Copays; Specialist Doctor Visit Copays; Inpatient Hospital Copays; Ambulance and Emergency Room Copays; and Drug Tier Copays helps companies to assess competitive advantages across markets. This type of comparative analysis provides invaluable intelligence that prepares Medicare plans to promote and sell their products.

In order to help Medicare plans access and use Medicare.gov data more efficiently, Mark Farrah Associates (MFA) maintains this data in its Medicare Benefits AnalyzerTM product. 2021 data is online now along with Star Quality Ratings to complement the benefits detail. Subscribers may query tables presenting plan benefit comparisons by state and county or download large datasets using the file export interface. Subscribers also have access to Medicare Business Online™ for tracking month-to-month Medicare Advantage and Prescription Drug Plan enrollment changes. Visit our website at www.markfarrah.com or call 724-338-4100 for more information.

1: MFA analysts noted that CMS corrected their calculation of Medicare eligible population for the October 2020 data. This correction dropped the reported Medicare eligible population from nearly 70 million down to 63 million.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health Plus™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.