Decreased Profit Margins for Majority of Leading Blue Cross Blue Shield Plans in 3Q20

January 28,2021

With recent events of the onset of the Covid-19 pandemic and the inauguration of a new president, the uncertain state of the healthcare landscape has insurers modifying business strategies to achieve stability within rough terrain. Blue Cross Blue Shield (BCBS) plans are no exception to this, as carriers scramble to ascertain the potential toll the pandemic could take on health business. Notwithstanding, BCBS companies continue to command a significant presence in every U.S. state and offer diversified products for commercial, Medicare and Medicaid business. In this brief, Mark Farrah Associates assesses 3Q20 profit margins of the top Blue Cross Blue Shield plans, comparing year-over-year performance as of September 2020.

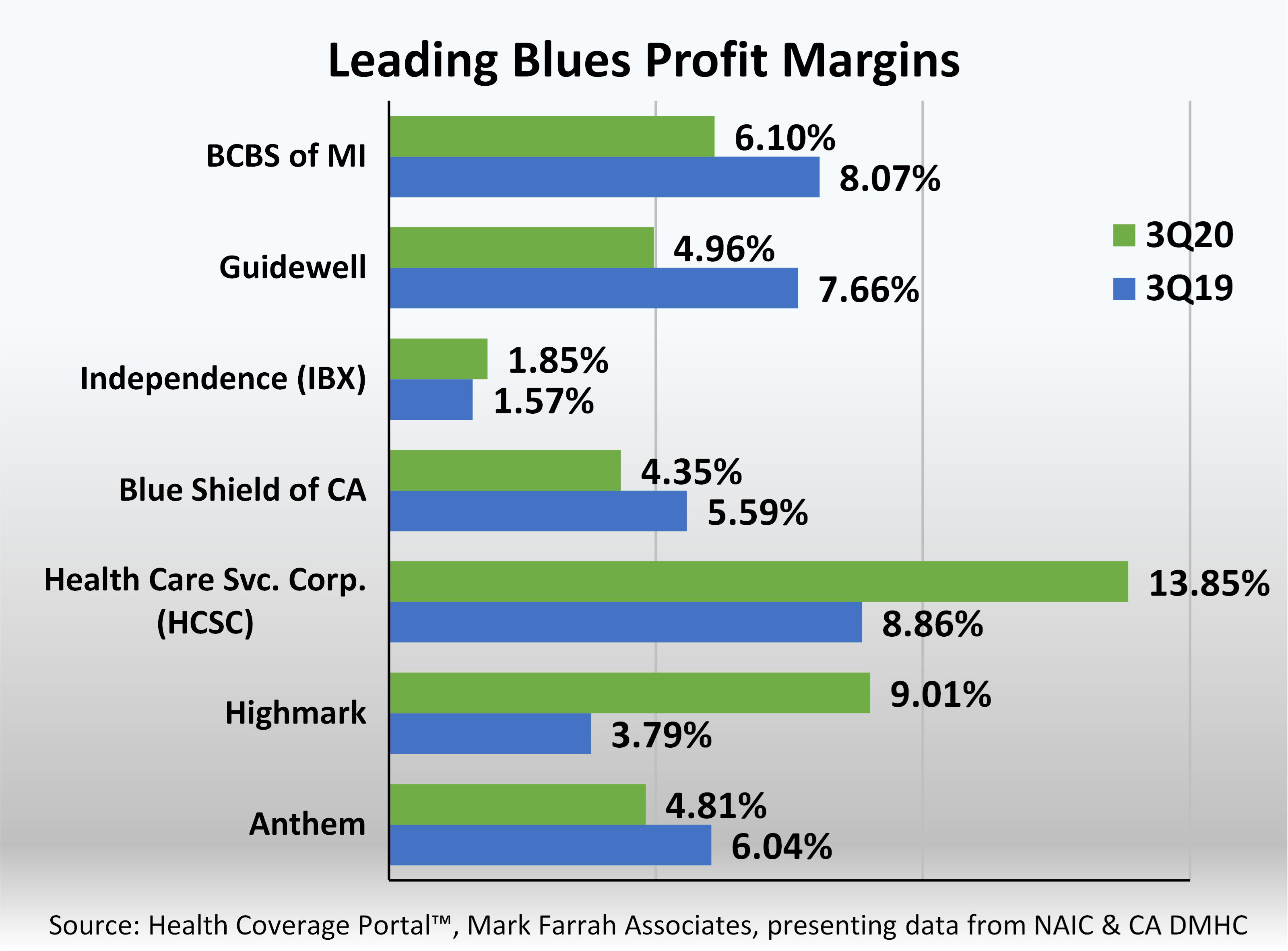

According to MFA’s Health Coverage Portal™, as of September 30, 2020, BCBS membership comprised 40% of total U.S. commercial enrollment, or nearly 111 million members. Blue Cross Blue Shield plans with over $10 billion in revenue at third quarter 2020 include Anthem, Health Care Service Corp. (HCSC), Blue Shield of CA, BCBS of Michigan Group, Guidewell Mutual Holding Group, Independence Blue Cross (IBX), and Highmark. Of the top seven BCBS affiliated insurers, Independence (IBX), Health Care Service Corp. (HCSC) and Highmark reported improved profit margins for 3Q20. The overall profitability for the remaining industry leaders shows a year-over-year decrease based on available statutory reporting as of September 30, 2020.

- BCBS of Michigan’s profit margin decreased over 24% from 8.07% in 3Q19 to 6.10% in 3Q20. This is due a 26% increase in combined claims adjustment and general administrative costs vs. 2019.

- Guidewell reported a 35.3% decrease with a profit margin of 4.96% in 3Q20, down from 7.66%, a year ago. This is, again, due to a 28% increase in combined claims adjustment and general administrative costs vs. 2019.

- Independence Blue Cross (IBX) experienced a slight increase in profit margin from 1.57% in 3Q19 to 1.85% in 3Q20.

- Blue Shield of CA also experienced a decreased profit margin from 5.59% in 3Q19 to 4.35% in 3Q20, due in part to increased administrative expenses.

- Health Care Service Corp (HCSC) continued to report the largest profit margin of the top Blues plans with 13.85% as of September 2020, a sizable increase from 8.86% at September 2019. This is due mostly to lower medical expenses as a percentage of revenue, most likely due to the impact of Covid-19.

- Highmark’s profit margin of 9.01% at 3Q20 is a significant improvement from 3.79% in 3Q19, mostly due to lower medical costs as a percentage of revenue and a 300% increase in investment income over 3Q19.

- Anthem’s profit margin of 4.81% fell from 6.04%, a year ago, due in part to higher administrative spending.

Blue Cross Blue Shield plans have been health insurance giants for decades, and with more than 80 years of experience, they are major contributors to the industry. After a profitable year overall in 2019, 2020 is proving Blues plans mostly continue to successfully adapt to the ever-changing landscape. Health insurers have experienced an impact on lines of business due to the pandemic, however federal and state legislation has been enacted in response including mandates to waive cost-sharing on COVID-19 testing and related services. While profitability results are mixed amongst Blues leaders for third quarter 2020, it is a wait and see proposition until final annual financial results are revealed this spring. Mark Farrah Associates will continue to analyze and report on important health insurance performance and related topics.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health Plus™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under Our Products or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.

Request Information

within 1-2 business days.